A Methodical Strategy to Bring Additive into Sheet Metal Fabrication

When Wilson Tool International launched its additive manufacturing division in 2018, it had already proven 3D printing’s value through dozens of printed parts for its own line of equipment. Demonstrating that value to customers required a new, highly focused approach.

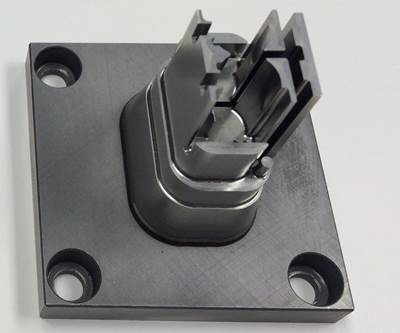

Produced at a significantly lower cost than traditional steel back guages, Wilson Tool Additive now prints these magnetic adjustable press brake back gauges using a variety of materials based on customer needs. These tools are meant to simplify the setup up for sheet metal forming and produce repeatable bends for low-volume production runs.

The value proposition that 3D-printed tooling presents to a typical machine shop — namely, cost savings and shortened lead times for fixturing and machine tool components — is in large part driving the adoption of additive manufacturing (AM) in job shops across the country. In this regard, it was not surprising to learn that Wilson Tool International, the world’s largest independent manufacturer of tooling systems and accessories for the tableting, stamping, bending and punching industries, began 3D printing in-house tooling back in 2010. But what sets Wilson Tool’s additive journey apart — the reason why its story is worth telling — is not revealed by asking why the company deployed 3D printing, but rather how it pushed beyond 3D printing for its own applications.

Wilson Tool International, which opened its doors in White Bear Lake, Minnesota in 1966, began experimenting with additive manufacturing (or what would come to be called by that name) in the late 1990s.

A view inside Wilson Tool International, the world’s largest independent manufacturer of tooling systems and accessories for the tableting, stamping, bending and punching industries.

The company purchased two fused filament fabrication (FFF) printers that it used to build prototypes and “look/touch/feel” models for some of the precision-ground press brake and punch tooling it offers to customers. While those customers include well-known companies in the appliance, agricultural and technology sectors, Wilson Tool deals mainly with small-to-mid-sized companies with less than 50 employees. As Andy Paulson, leader of Wilson Tool’s press brake sales division, put it during my visit to the company late last year, “We make and sell parts to companies that sell the products that people know.”

Many of those shops are small, independent sheet-metal houses that, Paulson says, have had little experience with AM. The manufacturing practices and technologies that these shops rely on are, in large part, firmly established. And many, he says, are skeptical of additive’s overall value and hesitant to change. But after years of experience using AM in-house, Wilson Tool realized something important: If the company had saved significant time and cost by 3D printing dozens of parts for its own equipment, there was no reason AM couldn’t gain a foothold in the metal fabrication industry at large. By 2018 Wilson Tool was so convinced in this assessment that it launched Wilson Tool Additive, an AM service bureau dedicated to changing hearts and minds in the sheet metal fabrication industry.

The Tapping Tool Tank Breakout

Wilson Tool Additive first came to our attention at Fabtech in 2018, the year that featured a greatly expanded 3D/Additive Manufacturing Pavilion situated between the finishing and forming/fabricating sections of the show floor. Wilson Tool was not located in the AM Pavilion that year, but one of the biggest draws to its booth was the company’s new, 3D-printed tapping tool tank.

The manufacturing process for these tanks used to involve fabricated cold-rolled steel that was punched and formed into multiple components. (Top image.) The company now 3D prints the tanks as one piece (bottom image) via digital light synthesis on Carbon machines.

Fabtech 2018 is where I met Wilson Tool’s senior additive manufacturing engineer Bryan Rogers, who explained why the 3D-printed reservoir represented such a giant leap in the company’s AM production capabilities. These oil reservoirs are a high-demand item due to the use of Wilson Tool International’s QuickTap tapping tools for punch presses at shops around the world. The manufacturing process for these tanks used to involve fabricated cold-rolled steel that was punched and formed into multiple components. These components were then welded together, followed by a lengthy testing process to test the seals under pressurization. All of this increased the lead time for the reservoirs and meant that Wilson Tool needed to maintain high inventory levels, which only drove up per-part costs even further.

Searching for a better solution, the company experimented with blow molding as well as machining the reservoir from aircraft-grade aluminum. Finally, in 2016, the company turned to 3D printing — specifically, to Carbon’s Continous Liquid Interface Production (CLIP) technology for Digital Light Synthesis (DLS).

Today the tanks are still one of Wilson Tool Additive’s biggest sellers. Printed as a single component with Carbon’s rigid polyurethane material, RPU 70, the part is up to 60 percent less expensive, at much lower risk for leakage and failure, and has a lead time up to 50 percent faster than the traditional part. The direct digital manufacturing of the part means there is no need to warehouse a large inventory of the reservoirs, and new iterations of the part can be achieved quickly.

Today, Wilson Tool Additive has a roster of more than 50 part numbers that it 3D prints in a range of polymers and metals for its own line of products, including identification keys, clamping units, coolant nozzles and back gauging for sheet metal forming operations. Including the two Carbon printers, the company operates a total of eight machines by Desktop Metal, Markforged, Ultimaker and Formlabs. Rogers estimates that 50% of these machines’ utilization is for in-house parts. The other 50% is for customers. Wilson Tool Additive’s greatest success for increasing that customer base has come methodically, one conversation at a time.

Talk to the Boss

Wilson Tool International’s customer base is about as varied as they come. The company provides tooling solutions to manufacturers of everything from computer chassis to refrigerators, agricultural equipment to aircraft carriers and submarines.

With the recent addition of a tablet press tooling division, Wilson Tool customers now include pharmaceutical as well as candy companies. Willy Wonka is a Wilson Tool customer.

During the 2010s the company spent several years leaning out its operations and becoming more agile with its inventory, increasing inventory turns while reducing stock out levels. Wilson Tool’s highest volume production part is its 1.25-inch die, which it sells upon the thousands to customers around the world.

Wilson Tool Additive fit into this global operation by offering customers two broad categories of 3D-printed parts it refers to as Bend 3D and Solve 3D. The first category includes a variety of forming and bending tools that are used to bend, punch or stamp sheet metal. Printed in a variety of both metals and plastics, these parts include clamps, topology-optimized back gauges (NC-controlled devices that help position sheet metal within a press brake) and letter-stamping tools. The second category are end-use or one-off parts that can replace items in a shop that otherwise would require an expensive mold to be created. These can also include jigs, fixtures and prototypes.

To spread the word about Wilson Tool Additive’s capabilities, the company has largely relied on the same strategy that Paulson and Rogers used to help launch it: Instead of talking only to shop floor managers or engineers, convince company leadership that additive is a worthy investment. And the best way to do that is in-person, face-to-face.

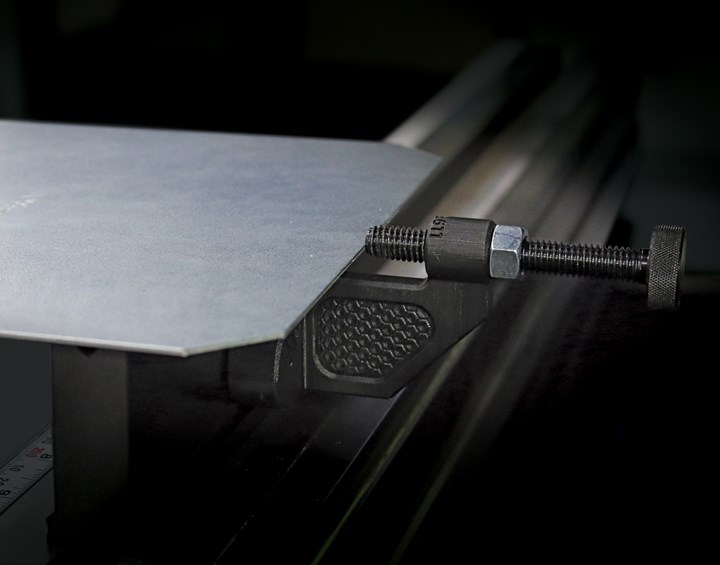

An example of in-house use of AM is this 3D-printed beam rest for a press brake tool. The ABS plastic beam relieves the hydraulic load on a press brake to avoid leakage when the system is not in use.

“Again, we're dealing with a lot of sheet metal houses, some with 50 or less employees,” Rogers says. “Someone might have read an article about 3D printing, but I think it's fair to say about the sheet metal industry that additive is still such an unknown. There needs to be a greater understanding of really what's going on out there and what additive can do.”

Until the pandemic, this meant a lot of travel for Rogers, spending time walking through a customer’s shop floor and assessing its day-to-day operations. Wilson Tool’s own experience using AM as a lean tool has taught him how to assess his customer’s processes and look for opportunities where additive can improve upon them. Sometimes this happens spontaneously, whether the customer is interested in additive or not.

“When we meet with customers, eventually someone will talk about an issue they’re having with a part,” Rogers says. “But for some of the end-use parts, when we ask if they would be open to making changes in the part for additive, sometimes the answer is no. Basically, it’s, ‘We’ve always done it this way and we’re not changing it.’”

“We have to challenge people on that,” Paulson says. “I think a lot of the end-use parts that we deal with on the metal side were designed in the ‘60s or ‘70s. They were designed to be made from D2 steel and that’s just the way it is.”

Hearts and Minds

Paulson and Rogers have learned that the best way to challenge “that’s just the way it is” is not to wax poetic about additive manufacturing, but rather to keep the conversation focused on engineering and supply chains. What is the part’s function? What are its load requirements? Will the part be used for low-volume operations? If so, a carbon fiber reinforced polymer or even a simple ABS plastic may be sufficient. For end-use and replacement parts, how long does it take you to get that part? How long is the machine sitting idle? How expensive is it?

Andy Paulson and Bryan Rogers from Wilson Tool International and Wilson Tool Additive. The two are largely responsible for driving the new additive division’s growth, with Rogers representing the only dedicated fulltime employee of the company.

Skepticism about additive manufacturing in the sheet-metal industry is not always a generational issue, Paulson says. He recounts one experience talking to a millennial shop owner about a 3D-printed part when the response was, “Cool, we’ve already printed that part.” But he’s also visited younger shop owners whose use of 3D printers stops at cupholders and office decorations. The same engineering and supply chain conversation will be just as relevant and important to that group, he says, as it will be to a shop owned and operated by baby boomers.

Case in point: During a recent conversation with a customer, Paulson learned that the company was having problems with a rivet machine manufactured in Taiwan. Specifically, this older customer was having problems with a small metal part that holds a spring in place. The part didn’t need to absorb weight or pressure. It was a simple cylinder sleeve for the spring, yet its replacement part had to be ordered from Taiwan.

Except it didn’t. A few simple questions around cost and downtime revealed that the part costs $100 and takes six weeks to ship — all while the machine is down and the company loses money. Bryan Rogers printed a few replacement parts at a cost of $5 each and shipped them the next day. They worked perfectly.

These conversations that focus on supply chain disruption and engineering are effective, Paulson says, but only when talking to the right person. Often that person is not the floor manager or an engineer, but rather a purchasing manager or the company president.

A Wilson Tool Additive letter stamping tool holder printed with stainless steel.

“Especially the machining parts side,” Paulson says. “Gauges, fixtures and all that kind of stuff seems to get a lot more traction when you present the situation as, ‘This part cost me X amount of dollars and takes this long to get.’” Rogers also cites another example of a customer who needed press brake gauging and was offered a 3D-printed solution. When the customer responded that he wanted steel, Rogers redirected the conversation. “They said that they wanted steel. Well, how many parts are you going to need? When they said 500, I explained that a 3D-printed gauge would produce thousands of parts. I explained that the additive part would cost $100 and I can ship it tomorrow. They asked for the cost of the steel gauge. I told them $750. Then it was basically, ‘How much is the 3D-printed one again?’”

Curiouser and Curiouser

Paulson and Rogers believe the growth potential for Wilson Tool Additive is high despite the company’s reliance on shoe-leather additive evangelizing as a key driver for gaining new customers.

These 3D-printed coolant nozzles printed by Wilson Tool Additive on Markforged machines. Wilson Tool used to manufacture these parts via wire EDM with a price point of $3500.

Bryan Rogers focuses the majority of his time toward Wilson Tool Additive, including leveraging the company’s research and development group to new growth opportunities within the division. Because additive is still largely a curiosity within the metal forming world, there is a push to educate customers and expand the business.

“We do have high hopes,” Paulson says. “We are taking it slow, but we are also pushing initiatives and investing more time and money into additive. I obviously want this company to be a successful additive service bureau that saves people money. But we need to get out there and educate customers on our materials and printing technology. Once you’ve printed them a part, it almost always takes the conversation to the next level. That's been our strategy.”

Related Content

3D Printed Cutting Tool for Large Transmission Part: The Cool Parts Show Bonus

A boring tool that was once 30 kg challenged the performance of the machining center using it. The replacement tool is 11.5 kg, and more efficient as well, thanks to generative design.

Read MoreThis Year I Have Seen a Lot of AM for the Military — What Is Going On?

Audience members have similar questions. What is the Department of Defense’s interest in making hardware via 3D printing over conventional methods? Here are three manufacturing concerns that are particular to the military.

Read MoreVideo: 5" Diameter Navy Artillery Rounds Made Through Robot Directed Energy Deposition (DED) Instead of Forging

Big Metal Additive conceives additive manufacturing production factory making hundreds of Navy projectile housings per day.

Read MoreAM 101: What Is Binder Jetting? (Includes Video)

Binder jetting requires no support structures, is accurate and repeatable, and is said to eliminate dimensional distortion problems common in some high-heat 3D technologies. Here is a look at how binder jetting works and its benefits for additive manufacturing.

Read MoreRead Next

3D-Printed Tooling Speeds Manufacturing of Cutting Tools

Knight Carbide's insert delivery times had to wait on custom tooling, so they acquired a Mojo desktop 3D printer from Stratasys to make their own. Lead times for insert carriers were shortened from weeks to just six hours.

Read MoreAdditive Manufacturing for Hard Tooling

Hybrid manufacturing is enabling tooling to be made with additive processes.

Read MoreWith Additive Manufacturing, No Tooling Is Required

In conventional manufacturing methods, tooling can easily cost hundreds of thousands of dollars. With AM, you print as needed, no jigs, fixtures or tooling required.

Read More