New Trend Forecast Reveals 3D Printing’s Impact on Manufacturing

A survey from Stratasys Direct Manufacturing offers insight on the value of 3D printing for manufacturers.

Share

Read Next

“3D printing’s greatest value is not as a technology, but as an enabler to derive greater business value.” This is the main finding of a new independent survey sponsored by Stratasys Direct Manufacturing, a division of Stratasys established in 2014 as a 3D printing and advanced manufacturing services provider that combines technology and experience from Solid Concepts, Harvest Technologies and RedEye, three previously separate companies brought together under the Stratasys Direct name. The company now has nine manufacturing facilities throughout the United States with 700 employees.

This survey asked professional users of 3D printing how they will use 3D printing over the next three years, what they see as the greatest benefits of and hurdles to 3D printing adoption, what they believe is its business value, how they see product development evolving, their plans to invest in owning the technology and what they believe the role of service providers will be.

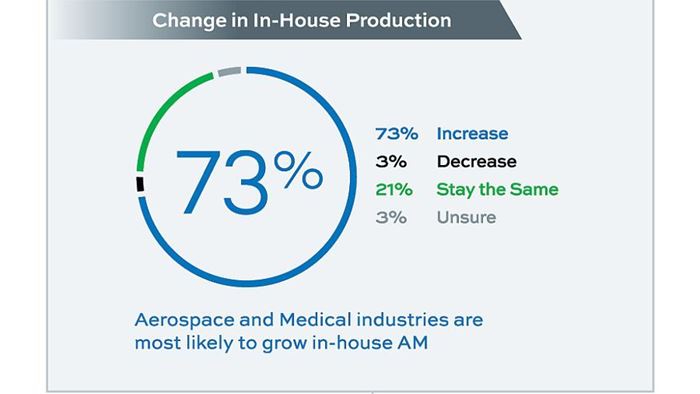

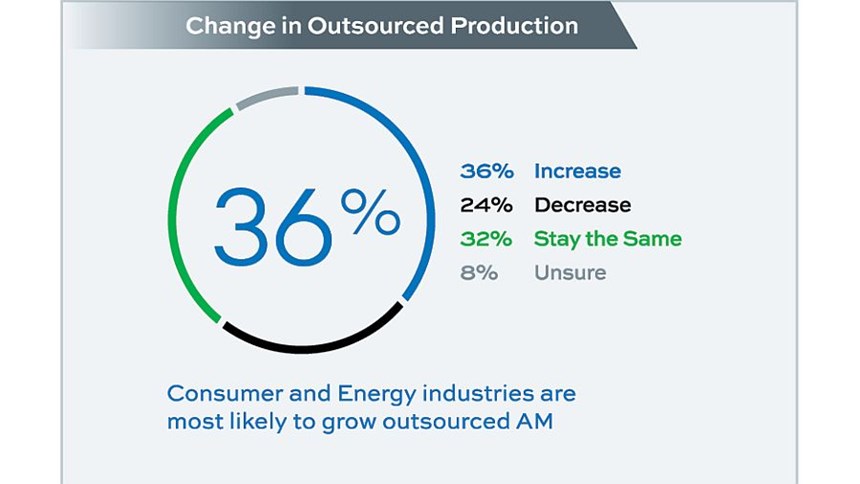

Overall, respondents expected their companies to expand their use of AM. Most will increase in-house capabilities to meet the demand, though many want a partner to augment their internal manufacturing capacity and guide them through the expansion of internal capabilities, providing technical support and design consulting .(See the two charts above for the breakdown between in-house and outsourced additive manufacturing.)

Joe Allison, CEO of Stratasys Direct Manufacturing, explained what the survey’s findings reveal about the future of 3D printing for professional users: “They confirm that the growth over the next three years will largely come in end-use production with an emphasis in metals. These two trends combine to drive the third trend: a demand for expertise and know-how. Companies need help identifying new additive applications to determine the technology that can best fulfill those needs. For end-use part production, they need support in optimizing 3D printing processes to bring costs down, while fully leveraging 3D printing’s benefits and its business value.”

Some key findings:

- The most significant perceived benefits of using AM are more complex design capabilities, reduced lead time for parts and improvements in manufacturing efficiency.

- Benefits to outsourcing AM include access to advanced equipment and materials, less investment risk, capacity to produce parts notable to be manufactured internally, and access to AM expertise.

- Two of the top four challenges are financial-based, indicating that cost remains a notable barrier to implementation.

- Issues having the greatest impact on the AM market range from cost of equipment and mechanical properties to the selection of materials available and design accuracy.

- When it comes to scaling capabilities and the role of the AM service provider, it was found that the consumer and energy industries are most likely to grow outsourced AM, and aerospace and medical industries are most likely to grow in-house AM.

- Changes in AM applications by 2018 include aerospace and automotive industries expanding their end-use part production the most, and a higher percentage of new end-use part production will be outsourced to service providers rather than done in-house.

- Respondents wanted to see further development with metals. This device is seen across all industries, with 84 percent of respondents interested in seeing more metal material development. Rubber-like materials and high-temperature plastics are in high demand for future use as well.

- The forecast for process growth according to respondents finds that laser sintering and additive metal processes are primed for future growth, with additive metal use expected to nearly double over the next 3 years. This market is more likely to turn to service providers rather than purchasing equipment because the latter can require additional equipment and a team for postprocessing.

The entire report is available at pages.stratasysdirect.com/trend-forecast.

Read Next

Crushable Lattices: The Lightweight Structures That Will Protect an Interplanetary Payload

NASA uses laser powder bed fusion plus chemical etching to create the lattice forms engineered to keep Mars rocks safe during a crash landing on Earth.

Read MoreAlquist 3D Looks Toward a Carbon-Sequestering Future with 3D Printed Infrastructure

The Colorado startup aims to reduce the carbon footprint of new buildings, homes and city infrastructure with robotic 3D printing and a specialized geopolymer material.

Read MoreProfilometry-Based Indentation Plastometry (PIP) as an Alternative to Standard Tensile Testing

UK-based Plastometrex offers a benchtop testing device utilizing PIP to quickly and easily analyze the yield strength, tensile strength and uniform elongation of samples and even printed parts. The solution is particularly useful for additive manufacturing.

Read More