Imagine a large OEM that needs parts for a new product—maybe an automaker that needs molded dashboard components for a new vehicle line. In a conventional supply chain, the OEM would first need to arrive at a viable design by prototyping, either in-house or by working with a third-party service provider. Then, it would need to find a supplier that could make a tool based on this design. The toolmaker may have additional recommendations to improve the functionality of the tool or manufacturability of the part, adding time and cost to the process. Once the tool is made, the OEM must turn to the supplier—an injection molder, in this case—who can use that tool and make the parts. Procuring the parts through the traditional supply chain is a winding road, with many stops from concept to delivery.

There are two key challenges to this approach. One is the need to have tooling manufactured, often the most time-consuming and costly step in the sequence above. But second is the need for many disparate suppliers and stakeholders to come together get the parts made. Ultimately, OEMs don’t want to buy designs or prototypes or tools; they want to buy parts.

Catalysis Additive Tooling believes it has the answers to both of these problems. The Powell, Ohio, company bills itself as a one-stop shop for part production, handling design through delivery. By leveraging 3D-printed tooling in combination with a network of strategic partners, the company is able to provide parts often in half the lead time and at half the cost of procuring them through the conventional supply chain.

Save at the Tool, Manage the Chain

Company cofounders Darrell Stafford and Rick Shibko are both veterans of Honda, where they saw firsthand the challenges in procuring parts on a large scale. During their tenure there, the automaker launched an initiative to reduce the development cycle for a new vehicle from 24 months down to just 12.

“How do you do that? How do you take a normal tool that’s going to take 12-plus weeks to produce, and maybe $50,000 or more, and reduce the timing and cost?” Shibko says. “3D-printed parts were not a solution, but we saw that 3D-printed tooling could be. Time and money are mostly spent in machining the tooling, and 3D printing allows you to manufacture the tool faster.” 3D-printed tooling helped Honda achieve a shorter, compressed development cycle, and motivated Shibko and Stafford to launch Catalysis Additive Tooling in 2015.

But another “aha!” moment came for Shibko at a conference where he spoke with a service bureau that was showing a 3D-printed injection mold. Intrigued, he asked, “Who designed this tool?” Answer: the customer. “Who made it?” Answer: the service bureau. “Who is going to do the injection molding?” Answer: the customer would find another supplier to handle production. Shibko was struck by this disjointed process, and saw that it would be easy for the parties involved to overlook opportunities to improve the tool or product, simply because none was seeing the full picture.

Catalysis’s founders decided that they could do better. They set about building a different system, so that when a customer comes to Catalysis to buy parts, the company can manage everything from product design through delivery, not only simplifying the process by giving the customer a single point of contact, but also improving the product by giving Catalysis the chance to help optimize designs, tooling and material choices at every stage of the process.

3D Printing Plus Partners

The end products the company provides are primarily plastic injection molded or vacuum formed parts and foam or composite parts made with 3D-printed tooling. Catalysis owns little equipment on its own—the importance of relationships begins here. Leveraging relationships with equipment suppliers, service bureaus, mold shops and others allows Catalysis to use the best technologies available for the job, not just the ones it has in-house. It also permits flexibility in part quantities.

“Our tag line is that we can support from one to one million parts,” Shibko says. Catalysis can handle prototype and low-volume runs of parts in house, while high-volume production is performed by strategic partners. Chief among them is D-Terra Solutions, an engineering and supply chain firm with contract manufacturers worldwide and nearly 30 years serving OEMs of various sizes. Once part quantities surpass the level that Catalysis can make itself, jobs often pass to D-Terra for completion.

The two companies describe the relationship as a “strategic alignment,” so much so that they are co-located in Powell and even share office space. Catalysis benefits from access to 3D printing equipment at the D-Terra Innovation Center and its supplier network, while D-Terra can draw on Catalysis’s 3D printing knowledge and often contracts the company for 3D-printed prototypes and other work. Each fills a gap in the other’s knowledge or capacity.

Collaborative relationships like this are not only mutually beneficial, but necessary, Catalysis has found. It would be impossible for the company to specialize in every stage of the supply chain for any scale, or to offer every available additive manufacturing technology in house. Catalysis’s role instead is to be knowledgeable about the available options, with a special focus on 3D-printed tooling, and to bring in the right players for each job.

“The tool we came up with is not a tool anybody would come up with just because they know 3D printing.”

The company’s combination of 3D printing expertise and ability to bring the right people together is what allows Catalysis to deliver parts quickly and at reduced cost, and both elements are vital. The injection mold tool shown above in Figure 2 is an example. Catalysis worked closely with both its injection molding partner and a direct metal laser sintering (DMLS) firm to create this unusual tool.

The final mold was produced in about two weeks. The cutouts on the part reduced the build time and material needed to 3D print the tool. Meanwhile, the fine honeycomb structure around the cavity also saves material, but acts primarily as a heat sink; air blown through the tool during the molding process can be used to carry heat away. The 3D-printed tool helped shorten the cycle time per part by 40 percent with conformal cooling channels, and as a result reduced the number of inserts the molder needed from 8 to 6. Part quality improved as well. “The tool we came up with is not a tool anybody would come up with just because they know 3D printing,” Stafford says. “You also need to understand plastic injection molding.”

Success with Innovation

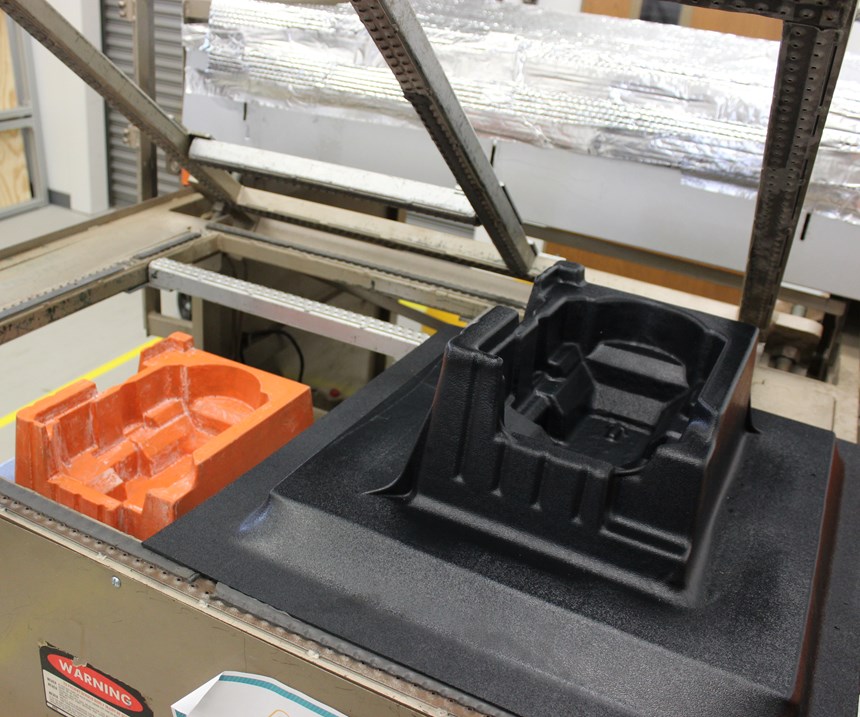

Catalysis recently made an investment in its own Advanced Manufacturing Center to be able to perform more R&D work near its office in Powell. This new facility includes equipment such as a thermoforming machine, injection molding press and casting equipment so that Catalysis can test prototype tooling, including unusual tools. While tooling is often made with fairly common processes such as fused deposition modeling (FDM) and DMLS, the company actively tests alternative and new solutions whenever possible. Experiments don’t always go as planned, but that’s part of the strategy. “Sometimes it works, and sometimes it doesn’t,” Stafford says. “We never fail, but we always learn.” Some of the unusual tooling solutions that have succeeded are illustrated below.

Sand-Based Vacuum Forming Tooling

Vacuum forming, a type of thermoforming in which a heated sheet of plastic is pulled onto a tool using suction, is commonly used for larger plastic parts such as panels and coverings that would be costly to injection mold. Plastic sheets are heated up to 350°F then sucked onto the tool and allowed to set for several minutes. Tools must be able to withstand this high temperature and long curing time. Polymer 3D-printed tools can warp during this process, while metal 3D-printed or machined tools are costly to manufacture.

Instead, Catalysis relies on binder jetting with silica sand, a process more commonly used to create molds for metal casting. (In fact the 3D printed sand forms are supplied by Humtown Products, a company that specializes in foundry tooling.) However, the sand material is cheap and can be quickly built up into large forms. To give these tools durability for repeated use, Catalysis infiltrates the sand with a proprietary resin that is then UV-cured. For end-use parts where a rough surface finish is acceptable or desirable, these tools can be used right away, because the porosity of the sand still enables the vacuum to form. For smoother parts, Catalysis treats the tool with a proprietary coating. A sand tool treated with both resin and coating can range to 60 HRC, sturdy enough to hydroform metal over the tool. (It will, however, lose its porosity so holes must be drilled if the tool is destined for vacuum forming.)

In a recent case, Catalysis made a vacuum forming tool for a drawer runner part this way. A metal tool would have cost about $4,000 and required 4 weeks to make. The sand 3D-printed tool cost $1,500 and was ready in one week; as a result, the customer was able to have three design iterations printed in the same time it would have taken to receive the metal tool, at a total price of just $500 more than that metal tool would have cost.

3D-printed tooling also enables the company to offer custom features that would otherwise be difficult to add. For example, Catalysis manufactured a cover for a grease pump marketed to barbecue restaurants (the black panel shown in Figures 1 and 5 above) that features the customer’s name, SmokeTech. To incorporate a logo like this on a conventionally manufactured tool would require additional machining or possibly EDM work to achieve, adding time and complexity to the manufacturing process. Adding this element to a sand 3D-printed tool, however, is cheap and straightforward.

Composite Injection Mold Tooling

For smaller plastic parts, Catalysis manufactures or sources injection mold tooling. For prototypes and short runs, the company might use the SLA printers readily available in D-Terra’s Innovation Center. These molds are durable enough to use for a short time, but tend to crack after repeated use. Meanwhile, metal 3D-printed molds remain costly to manufacture and require finish machining before use.

In searching for a durable, cost-effective alternative to strict polymers and metals, Catalysis came across another option: Digital Composite Manufacturing (DCM). Developed and used by Fortify, a Boston-based startup, DCM uses a stereolithography-like process to cure liquid resin filled with reinforcing fibers; electromagnetic solenoids around the resin container control the position and direction of these fibers for optimal strength where it is needed.

Catalysis worked with its injection molding partner and Fortify to develop a composite mold that was 3D-printed with a ceramic-filled resin (Figure 6). The resulting mold required no postprocessing and supported 150 runs of the polypropylene part, and then 50 runs in nylon, with no decrease in tool performance.

Experiments like these help Catalysis grow its knowledge in 3D printing, while adding new partners to its network that can be called upon for future jobs. The better Catalysis understands the various available technologies and the wider its network, the greater the benefit to the customer.

Indeed, if Catalysis can get that network wide enough, it can turn that winding road at the beginning of this story into an expressway—and 3D printing is the on-ramp. Return for a moment to the OEM at the beginning of this story. What might an alternative supply chain look like? The OEM could turn to a company like Catalysis as early as the design process. That agent could handle prototyping; it could transition from there to create the best tooling for the part and process, likely collaborating with partners; and it could transition in the same way toward having the parts manufactured on a flexible scale. From the OEM’s perspective, design changes are easy to implement, and parts arrive faster and at lower cost. Those parts are also likely to be of better quality, as the result of tooling innovations and collaboration throughout the processes. Catalysis’s particular brand of supply chain management aided by 3D-printed tooling and strategic partners could be the fast track to market.

Related Content

Why AM Leads to Internal Production for Collins Aerospace (Includes Video)

A new Charlotte-area center will provide additive manufacturing expertise and production capacity for Collins business units based across the country, allowing the company to guard proprietary design and process details that are often part of AM.

Read MoreAdditive Wins on Cost, Plus Process Monitoring and More from RAPID + TCT 2023: AM Radio #38

Additive manufacturing is finding success as a cost-effective manufacturing method. New options for process monitoring are now available. DED is getting more precise. 3D printed chairs! What we learned and observed at RAPID + TCT 2023.

Read More6 Considerations When Launching an Additive Startup

Recent additive manufacturing (AM) startup owner, JP Kinerk, shares his experience by offering helpful advice for others just starting out in the additive realm.

Read MoreAdditive Manufacturing Is Subtractive, Too: How CNC Machining Integrates With AM (Includes Video)

For Keselowski Advanced Manufacturing, succeeding with laser powder bed fusion as a production process means developing a machine shop that is responsive to, and moves at the pacing of, metal 3D printing.

Read MoreRead Next

3D Print the Tool to Cast the Mold to Make the Part

3D-printed molds to manufacture parts are familiar, but what if the mold itself was made with a 3D-printed tool? Catalysis Additive Tooling proves out this concept in a mold for a fiberglass part.

Read More3D Printer Parts Made with 3D Printed Tooling: ExOne Walks the Walk

Accelerated timelines, fast design changes and low volumes — in many ways, 3D printing is the right market for 3D printing. ExOne’s newest generation of machines includes parts vacuum formed on 3D printed tools developed by Catalysis Additive Tooling.

Read MorePostprocessing Steps and Costs for Metal 3D Printing

When your metal part is done 3D printing, you just pull it out of the machine and start using it, right? Not exactly.

Read More

.jpg;width=70;height=70;mode=crop)