Why Moog Makes Sense as the Majority Owner of Linear

In the wake of the Moog purchase, AM Magazine spoke with Linear’s founder, and also with the new general manager of the company that is now called Linear AMS.

Update 8/16/2017: Founder John Tenbusch has again become majority owner of Linear AMS. Story as originally posted appears below this line.

The company now called Linear AMS has recently been swapping machine time for scientist time.

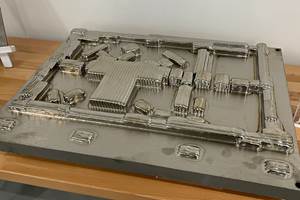

It has the machines. Linear’s capacity for additive manufacturing now includes 20 powder bed machines for making metal parts.

Meanwhile, the scientists belong to its new majority owner, Moog, the engineering and manufacturing company that is particularly active in the aerospace sector. Before buying its stake in Linear, Moog was exploring additive in its own R&D facility, the Additive Manufacturing Center (AMC) in East Aurora, New York. That facility had become quite busy—it had a backlog of parts to run. Linear can assist with that problem.

But Linear has recently been challenged by customers seeking to build parts from exotic materials for which the processing parameters are as yet unknown. And this is where the AMC is valuable. Thanks to the staff and resources of this facility, Linear is now able to qualify a new material and begin making production parts with it in 30 days—a speed that was previously unthinkable. This swap, production capacity for process knowledge, exemplifies the synergy between the two companies.

To discuss this at length—that is, to discuss the Moog purchase, the synergy and the way forward for the now jointly owned Linear AMS—I recently met with company founder John Tenbusch and David Hodge, the Moog employee who recently reported to Linear as the new general manager.

Approach to Market

The first and most basic point is this: The two companies are still separate, to an extent. The purchase was not a complete acquisition. Moog bought 70 percent of the Detroit-area firm known then as Linear Mold & Engineering, leaving founder Tenbusch with 30 percent. His title is now vice president. Hodge, a 20-year Moog veteran who has relocated to Michigan to assume his new role, is the only Moog employee to have been formally added to the Linear AMS staff in this way. The new name of the company includes an abbreviation meant to be flexible, standing for either Additive Manufacturing Services or Advanced Manufacturing Solutions. The change to the name is also meant to be slight, because the Linear name is important. The company will continue to go to market the same way it did previously, Hodge says.

The point of the purchase was not to take Linear’s capacity away and make it Moog’s, he says. That would not make sense—the new owner does not have enough AM activity to merit that absorption. Instead, Linear will be a source of revenue for Moog, one that the new owner plans to build up through investment, while at the same time providing Moog with ready access to AM capacity and expertise that it can draw upon to solve engineering problems for customers.

In fact, he explains that a big part of the advantage that Moog brings to Linear is that it knows what these problems are.

Engineering Influence

Moog is an engineering company. “Our simple aim: We want to be the best engineering company in the world,” Hodge says. Where Linear makes parts, this larger company develops engineered systems such as fuel and control systems for aircraft. And given the complexity of what it produces, it gets to be involved in customers’ engineering decisions far earlier and at a higher level than Linear was previously able to. For the success of additive manufacturing, that early access is vital.

That’s because AM is not strictly a replacement for other means of making parts. AM’s promise is instead realized when it gets to make new parts—parts designed to take advantage of what additive can do. Moog, more than Linear ever could on its own, is able to influence those early design decisions.

It was already doing this, in fact. Well before the Linear purchase, it opened the AMC because of its recognition that additive will play an increasingly important role in the engineering needs of its customers. An example of a success that came before Linear was the redesign of an actuator for the leg of a quadruped robot being developed for search and rescue. Previously, the complexity of the assembly and cabling of this component affected its reliability and freedom of motion. Redesigning the part for AM allowed components to be consolidated, and allowed passages to be grown internally for hydraulic connections. In the AM version of this part, five previously separate components were combined into one, and what used to be an intricate and messy assembly became a streamlined package. Successes such as this have made it clear to Moog that it will be using AM to advance and improve many more similarly complex systems in the future.

Capacity and Capability

Tenbusch was seeing the same potential. However, he needed capital to pursue it. The long-term promise of AM as a production resource would justify many more powder-bed machines than his company’s current 20, but here was the dilemma: While Linear needed capacity to win more business, it couldn’t pursue that business without the capacity.

Moog’s size and funding answered that dilemma, and answered another challenge as well, he says.

In addition to growing, Linear also had to become more sophisticated. Tenbusch says the company was hitting its limits in terms of how efficiently it could respond to the kinds of demands that customers are increasingly bringing. Those demands relate to part quality requirements and new materials. When it was independent, Linear was reliant on process parameters provided by the additive manufacturing machine makers for processing the various metals it worked with. But customers moving into production with AM often insist on repeatability requirements surpassing what machines running those parameters typically achieve. Customers are also asking Linear to work with metals for which no defined parameters yet exist. In such cases, the machine suppliers cannot help, because Linear generally can’t share the specifics of customers’ demands without violating a non-disclosure agreement (NDA).

“Demands like these have to be met with science,” says Tenbusch, but his company was too busy making parts. It lacked the capacity for experiments, and it lacked the equipment and skills for an extensive amount of analytical R&D. Now, through Moog, it has these things.

His company also previously lacked the mindset for R&D work. The methodicalness of qualifying and systemizing capabilities fits more with the culture of Moog. Linear’s founder notes, “If I had a little extra money, I would think about buying something for making parts, like a new lathe.” Yet soon after the Moog purchase, the company was given a very different piece of equipment: a high-capacity microscope. Visitors from the larger company quickly taught Linear’s staff how to use it. Now, material qualification—which was formerly outsourced when it was performed—is a routine part of Linear’s process. The company would have eventually developed the capability, says Tenbusch, “but not nearly as fast as Moog got us there.”

Productionization

Adding the microscope was a small step in a much larger goal, says Hodge. To quote his word, additive manufacturing must become “productionized.” That is the way forward for AM in general, and it will be the way forward for Linear AMS.

Making the additive manufacturing process more production-capable will mean adding process controls and inspection standards, so that a given part can be produced repeatably not just a few times on one machine, but hundreds of times on any machine in the facility. Moog is well equipped to help with this, as the company routinely brings the same kind of disciplines to processes involving extensive supply chains. The company can also help with a related goal, he says: lean manufacturing. Advisors from the engineering company have been to Linear with this very purpose in mind, to the extent that within just a month or so of the announcement of the purchase, there were already the beginnings of value stream maps on a meeting room in this facility.

Yet Linear will not come to look too much like Moog, says Hodge. It remains a separate company, and will function that way. Separation is necessary if it is to continue serving customers as it has, in part because some NDAs require this. (Other cases allow for three-way NDAs including Moog.) Additionally, continued success for Linear will require Linear’s culture to continue—a culture that is, as has been noted, distinct from Moog’s.

In fact, there is some hope the reverse effect might occur—that a bit of Linear might inspire Moog. Hodge notes that both companies were founded by entrepreneurs, one just 50 years ahead of the other. Tenbusch has been touring different sites within his new partner company, seeing the way an inventive mindset remains a part of the culture. Hodge echoes this, speaking of the enthusiasm he has met within the company in the wake of the Linear purchase. Engineers throughout the organization now have a new tool with which to innovate, and a new solution to apply toward current and future challenges. Previously, Moog’s innovators could investigate or experiment with AM, but now the company has the capacity to confidently move forward with additive in every application that can benefit from it.

Related Content

Additive Manufacturing Is Subtractive, Too: How CNC Machining Integrates With AM (Includes Video)

For Keselowski Advanced Manufacturing, succeeding with laser powder bed fusion as a production process means developing a machine shop that is responsive to, and moves at the pacing of, metal 3D printing.

Read MoreHow Norsk Titanium Is Scaling Up AM Production — and Employment — in New York State

New opportunities for part production via the company’s forging-like additive process are coming from the aerospace industry as well as a different sector, the semiconductor industry.

Read MoreDMG MORI: Build Plate “Pucks” Cut Postprocessing Time by 80%

For spinal implants and other small 3D printed parts made through laser powder bed fusion, separate clampable units resting within the build plate provide for easy transfer to a CNC lathe.

Read More3D Printing with Plastic Pellets – What You Need to Know

A few 3D printers today are capable of working directly with resin pellets for feedstock. That brings extreme flexibility in material options, but also requires greater knowledge of how to best process any given resin. Here’s how FGF machine maker JuggerBot 3D addresses both the printing technology and the process know-how.

Read MoreRead Next

Postprocessing Steps and Costs for Metal 3D Printing

When your metal part is done 3D printing, you just pull it out of the machine and start using it, right? Not exactly.

Read MoreCrushable Lattices: The Lightweight Structures That Will Protect an Interplanetary Payload

NASA uses laser powder bed fusion plus chemical etching to create the lattice forms engineered to keep Mars rocks safe during a crash landing on Earth.

Read More3D Printed Polymer EOAT Increases Safety of Cobots

Contract manufacturer Anubis 3D applies polymer 3D printing processes to manufacture cobot tooling that is lightweight, smooth and safer for human interaction.

Read More