What a Ride: Investment Trends in Additive Manufacturing

Additive manufacturing remains a growth industry with double-digit, year-over-year growth rates.

Share

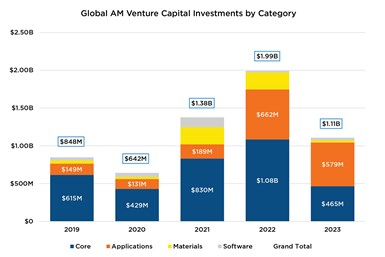

Since 2019, the additive manufacturing (AM) industry has ridden a proverbial roller coaster that hasn’t quite returned to the station. Two years beyond record-breaking investment and acquisition activity, AM may be ready for one more climb. Revisiting the best financial leading indicators available will tell if that climb will be realistic and sustainable. Investments in AM are categorized by four groups separated by value chain position as well as technology.

- Core investments represent developers across AM processes, 3D printers and postprocessing equipment alongside 3D printing service providers, online marketplaces and other hardware technology enablers.

- Applications companies include specialized service companies focused on a particular industry or product class, such as heat exchangers, consumer goods or medical implants.

- Materials investments cover materials suppliers, formulators and developers.

- Software includes companies with a specialization in AM software across the computer-aided design, engineering or manufacturing workflow.

Global venture capital investment in AM companies has decreased 44% from its $1.99 billion peak in 2022 to $1.11 billion in 2023. Since 2019, the $1.11 billion represents a 5.5% five-year compounded annual growth rate, which does little to capture the disproportionate decrease and subsequent investment excesses resulting from the global COVID-19 pandemic.

More notable for 2023 than the 44% drop due to changing investor sentiment across the investment landscape was the $579 million in applications investments. The 12 application deals in 2023 represented 21% of all deals and 56% of all dollars compared to the 22 application deals in 2022 with 28% and 33%, respectively. The 2023 data reinforces the investment trend observed the prior year — applications matter.

Investors continue to focus on product-market fit opportunities with specialization and the promise of services at scale. Notable service business model companies that raised significant funding in 2023 include Divergent, FreeFORM, Seurat Technologies, Arris Composites, Alloy Enterprises and Zeda. Furthermore, nearly all these companies have developed technologies or processes that help them offer differentiated manufacturing services.

Average investment size decreased to $23 million for 2023, down nearly 15%, despite large investments into Seurat Technologies, Divergent and Ursa Major. This decrease in the average is in line with fewer large investments in 2023 compared to an overexuberant 2021-2022 and also in line with publicly traded company values decreasing in 2022-2023.

In light of 2023 activity, AM remains a growth industry with double-digit, year-over-year growth rates. While 2023’s venture investments trended down, the application focus was reaffirmed and retains some of the industry’s currently overshadowed successes.

The AM roller coaster’s loops and turns appear to be coming to an end as the industry finally approaches the station, where a stable foundation awaits application companies and service business models getting ready to begin a slow and steady climb toward sustainable product-market fit.

For the full article and more graphs, which includes analysis of mergers and acquisitions, visit AMTonline.org/article/What-a-ride-investment-trends-in-additive-manufacturing.