To Grow Additive Manufacturing Adoption, HP Is Aiming for the C-Suite

3D printing has been largely the purview of service bureaus and technical specialists but HP sees a future where it is increasingly the concern of OEM executives — and the company is taking steps to reach them.

Since the launch of its Multi Jet Fusion (MJF) platform for 3D polymers in 2016, HP has rapidly become a major supplier of 3D printing technology. But increasingly, the company is seeing its additive manufacturing (AM) interests extend beyond the sale of equipment.

“The hardware is only a means to an end,” says Didier Deltort, president and global head of HP’s Personalization and 3D Printing business. “Additive manufacturing is not growing exponentially, so we need to capture value on parts and find applications where AM can disrupt.”

The Arize Orthotic Solution is an end-to-end offering for podiatrists and orthotists that includes scanning technology and software as well as 3D printing services to deliver the final orthotic inserts for patients.

Photo Credit: HP

When I sat down with Deltort in July at HP’s Center of Excellence in Spain, he had been leading the 3D printing business unit for just over a year. A past HP alumni, Deltort returned to the company in 2021 following a career that has been largely in the healthcare industry (most recently at GE Healthcare). His appointment coincided with the renaming of this unit to Personalization and 3D Printing, a moniker that encompasses quite a bit. HP offers 3D printing solutions for both polymers and metals in the form of its Multi Jet Fusion (MJF) and forthcoming Metal Jet platforms, respectively. But this business also encapsulates HP-owned product lines produced with this technology — many of which are customized for an end user or consumer, accounting for the “personalization” aspect of the name. These include Arize, a custom orthotics solution, plus Molded Fiber Advanced Tooling and Sustainable Packaging, two related businesses in which MJF-printed tooling is used to form paper pulp into products and packages such as compostable bottles.

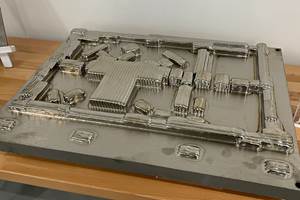

Multi Jet Fusion 3D printed tools for molded fiber avoid the labor involved in producing tools from metal and provide performance benefits as well. Photo Credit: HP

In other words, Deltort has a lot on his plate — but it’s a mix that starts to make sense upon hearing how HP is now thinking about additive. While the company is committed to supporting existing users, it is now more actively seeking out new users with the potential to rapidly scale and promoting additive disruption in new markets. These goals have necessitated a subtle but important shift in strategy.

Where in the past most 3D printing equipment sales have been to smaller users (service bureaus, independent contract manufacturers or even champion-led AM efforts within larger enterprises), Deltort and HP see greater adoption, and greater disruption, coming as discussions about AM increasingly include CEOs and other top leaders at large OEMs.

Why? Because OEMs are the ones determining what gets made; they are driving decisions about sourcing, about part and system designs, and about the orders that ultimately reach service bureaus and contract manufacturers.

To scale additive manufacturing, “You’ve got to go to the C-suite.”

Didier Deltort, president and global head of HP’s Personalization and 3D Printing business (pictured here introducing a speaker for the HP Women in 3D Forum) has been leading this unit since 2021. He and other members of the leadership team bring expertise in advancing new ideas and applications within large organizations. Photo Credit: HP

To scale additive manufacturing, “You’ve got to go to the C-suite,” Deltort says. He and several other recent hires to the business’s 3D printing leadership have been on the other side of the conference room table, and are familiar with the kinds of questions, concerns and needs that companies like this may have. Some have also been in the position of advancing additive manufacturing applications, including François Minec, previously global managing director of BASF 3D Printing/Forward AM, who now heads global strategy for the HP Personalization and 3D Printing business. Part of HP’s strategy moving forward is to identify new customers with the potential to adopt additive manufacturing at high scale, and to anticipate and smooth out any roadblocks in that adoption journey.

For now, a majority of the company’s hardware sales are still to service bureaus and contract manufacturers. But by 2025, HP expects that the larger percentage of its business will come from OEMs. And it is taking steps to get there, including appointing general managers and specialists to key market segments such as automotive, medical and consumer goods. The company is also making extensive investments into process development customers headed for scale. A Parts Manufacturing Lab located at Spain’s DFactory (“Digital Factory”) is partially devoted to developing end-to-end production for Multi Jet Fusion, for example, so that adopters will have not only a full “recipe” for their part production but also insights into everything from the mix of equipment they’ll need, to anticipated uptime and utilization, to accurate cost estimates.

But supporting external customers is not the only way that HP intends to grow AM adoption. To put it bluntly, there are opportunities the company sees where AM is advancing too slowly. HP has stepped into some of these slow spots, becoming an additive manufacturer itself in order to accelerate adoption in these markets.

Sustainable packaging is one example. With pressure to phase out plastic packaging in various parts of the world, molded fiber options are one possible alternative. But these items today are commonly molded on metal tooling often made manually with slow turnaround, in processes that consume a substantial amount of energy. HP identified molded fiber packaging as an opportunity for MJF tooling, and earlier this year announced its acquisition of Choose Packaging. It is currently working with 20 brands on the development of 3D printed tooling to produce compostable, molded fiber bottles, and expects to move into a pilot phase with brands as they advance product testing.

3D printed tooling supports better quality and faster production for molded fiber packaging, like these plastic-free paper bottles developed by Choose Packaging. Photo Credit: HP

Packaging represents a market that might have adopted and advanced with 3D printing on its own, but Deltort and HP believe it is achieving its potential much faster with HP involved as an active participant. The company projects that sustainable packaging could be a half-billion-dollar industry by 2025; while molded fiber made on 3D printed tools won’t be the only plastic alternative, HP believes it could address up to 20% of this market.

Ultimately, this is the kind of use case the company is after: additive manufacturing operating at scale, and providing real value for adopters and end users of what this technology can produce. Isolated use cases are no longer enough; it is easy to get distracted by showy “museum” parts, Deltort says, “but how many of them have become million-dollar businesses?” From HP’s perspective, this is the new test for additive manufacturing, and passing it will mean new waves of disruption across companies and industries.

Related Content

Two 12-Laser AM Machines at Collins Aerospace: Here Is How They Are Being Used

With this additive manufacturing capacity, one room of the Collins Iowa facility performs the work previously requiring a supply chain. Production yield will nearly double, and lead times will be more than 80% shorter.

Read More3D Printed Titanium Replaces Aluminum for Unmanned Aircraft Wing Splice: The Cool Parts Show #72

Rapid Plasma Deposition produces the near-net-shape preform for a newly designed wing splice for remotely piloted aircraft from General Atomics. The Cool Parts Show visits Norsk Titanium, where this part is made.

Read MoreVideo: 5" Diameter Navy Artillery Rounds Made Through Robot Directed Energy Deposition (DED) Instead of Forging

Big Metal Additive conceives additive manufacturing production factory making hundreds of Navy projectile housings per day.

Read MoreHow Norsk Titanium Is Scaling Up AM Production — and Employment — in New York State

New opportunities for part production via the company’s forging-like additive process are coming from the aerospace industry as well as a different sector, the semiconductor industry.

Read MoreRead Next

Why HP Believes in 3D Printing

The reasons go beyond the world of manufacturing. Ramon Pastor, global head of plastics solutions for 3D Printing and Digital Manufacturing, shares the four macrotrends at the foundation of HP’s 3D printing business.

Read MoreWhat Your CEO Needs to Know About Additive Manufacturing

Additive manufacturing promises to affect far more than manufacturing alone. When evaluating AM, the perspective needed is the view that sees the impacts all across the enterprise.

Read MoreAlquist 3D Looks Toward a Carbon-Sequestering Future with 3D Printed Infrastructure

The Colorado startup aims to reduce the carbon footprint of new buildings, homes and city infrastructure with robotic 3D printing and a specialized geopolymer material.

Read More

.jpg;width=70;height=70;mode=crop)