What is the case for making production parts using additive manufacturing (AM)? Is the value to be found in the design freedom that allows for consolidating assemblies or optimizing geometry for weight savings? Is the value of additive to be found in the chance to explore new material possibilities? Yes and yes, says HP's Stephen Nigro. Yes to all of this. However, there is one straightforward obstacle standing in the way.

“You have to get the economics right,” he says. “Once 3D printing becomes the economical choice for production, companies will use it, and then they will go on to realize all those other advantages from additive.”

Nigro is president of HP’s 3D Printing business. Two years ago, the company launched a 3D printing platform for production of plastic parts. Now, with its latest introduction, the company is expanding its offerings to include a metal 3D printer. (Watch the launch.) The target market for this new machine is not components representative of where metal AM is already succeeding—that is, not high-end components such as aircraft parts, not components made of exotic alloys—but instead automotive parts and other applications comprising the lion’s share of industrial production. The target materials are iron and steel, starting with stainless.

I recently had the chance to visit HP’s engineering, research and manufacturing campus in Corvallis, Oregon, learning about the introduction of the metal 3D printer and the advance of 3D printing at the company through conversations with Nigro along with Timothy Weber, Ph.D., the company’s global head of 3D metals. “3D printing is the biggest long-term bet HP is making,” Nigro told me, and I saw this. In various departments and disciplines at the Corvallis site—microfluidics, printhead engineering, ink chemistry, analytical research—I was introduced to people who had been redeployed from document and graphic media creation to additive manufacturing. That is, redeployed from 2D to 3D.

In discussing this, HP employees routinely use the term “3D printing,” preferring this to “additive manufacturing.” The reason for the preference is perhaps obvious, but it is also key. Weber notes that the crucial, unique and sustainable advantage that HP brings to the additive space is found in its innovation and IP related to printhead and ink technology, coupled with its ability to keep on innovating in these areas. The printhead and ink technology able to print commercial media at industrial scale, speed and quality can also be produced and applied inexpensively enough to serve consumer document printers, thanks to HP’s in-house manufacturing of these components. Now, that same technology is being extended ever-farther into making physical, functional parts. In HP’s view, fast, accurate, economical printing technology is the enabler that will allow additive to, in Nigro’s words, “get the economics right,” competing with conventional processes for mainstream production applications. Strange as it might seem, the next logical extension of document printing know-how will be production of metal parts.

Printheads for Production

The new HP “Metal Jet” (MJ) printer makes parts through binder jetting. This is an established additive manufacturing technology, and the additive technology falling squarely within HP’s established areas of strength. Binder jetting is the AM process that most resembles document printing.

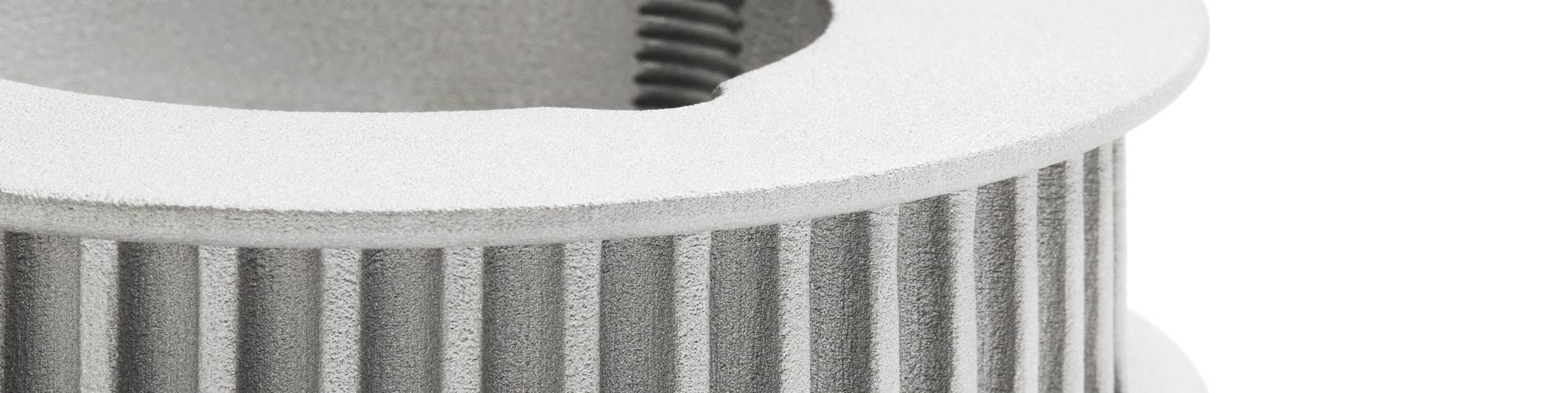

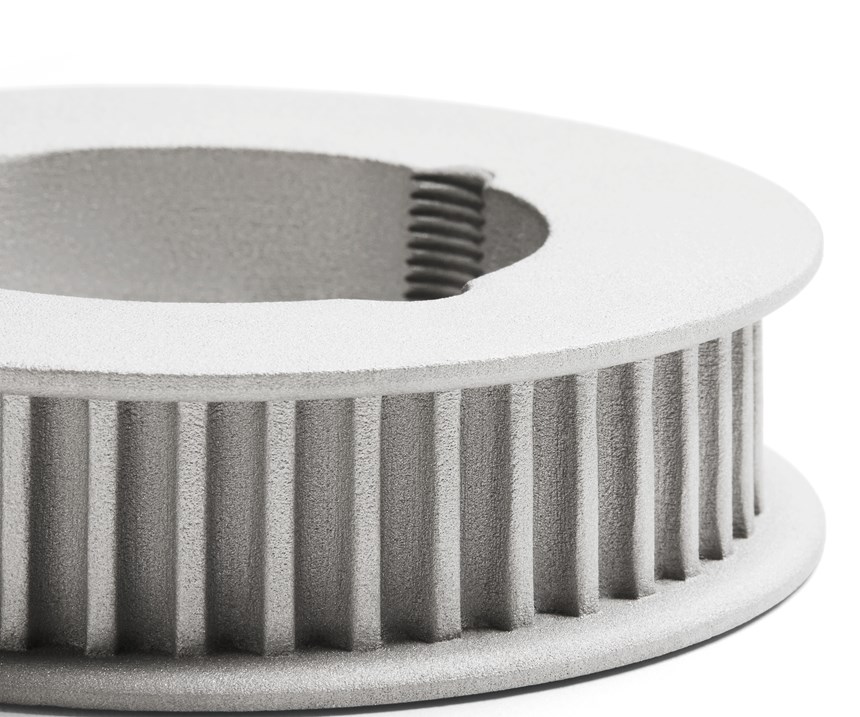

In binder jetting, the metal does not change phase. It does not melt; there is no laser or electron beam. Instead, fluid droplets cause the metal powder to adhere, producing a “green” part. The powder metal in question can be the same widely available powder that might otherwise be used for metal injection molding. A sintering oven then completes the 3D part by burning away the fluid and solidifying the part into its fully dense, fully hardened state. The functionality and consistency of the resulting part’s microstructure are at minimum equivalent to casting. An “area” process in which the binding agent is applied to the entire cross-sectional area of the build with each pass of the printhead array, binder jetting is inherently fast. HP has applied its printhead technology to making it faster. Meanwhile, the company’s resources related to ink development have been focused on developing the binder agent, producing a proprietary agent effective enough so that the quantity of agent needed is less than 1 percent of the green part by mass.

Another benefit of binder jetting: no support structures. Loose powder supports the parts as they are built, including supporting parts one above another. All of the new machine’s build envelope of 430 × 320 × 200 mm, in all three dimensions, is therefore available for nesting parts. In both speed and capacity, the machine aims for production.

Planned price tag is under $399,000, Nigro says, but the company is not selling the machine yet. It won’t sell it to the broad market for two years. Instead, learning from the experience with one of its leading users of the plastics 3D printer, HP will begin with contract manufacturing by launching a parts production service.

Upload Your Parts

That leading user of HP’s plastics 3D printing platform, Multi-Jet Fusion (MJF), is a small company that proved to be a big champion for the technology. California-based Forecast 3D started as a service bureau for 3D-printed prototypes, but became a production house for 3D-printed plastic parts through its commitment to MJF. Ultimately it bought 24 of these machines, and it made many of its customers into believers in production 3D printing through its ability to deliver production quantities of design-optimized plastic parts with little lead time and no need for molds or other tooling. HP sees this model—partnering with manufacturers able to explore and advance the technology—as the way to introduce and prove out its metals platform.

Going bigger with this model, HP has chosen as its partners for the new metal parts production service the contract manufacturer GKN, which serves industries including automotive, heavy industry and aerospace, and Parmatech, which is well-established in medical. These two companies are already using MJ printers, these two companies will seek opportunities to expand manufacturing possibilities for their customers using these machines, and these two companies will also fulfill orders for production parts placed through a new HP-hosted online manufacturing portal through which customers can order parts by uploading CAD files. HP expects prospective future users of the metal 3D printer to employ this service as a low-cost way to become familiar with it before the machine becomes available to the broad market in 2021.

Automotive Application

One other notable early user is Volkswagen. Nigro and Weber say this carmaker is on its own multi-year trajectory with the MJ machine, planning to apply it first to mass customizable parts such as key fobs and exterior details and then to functional components such as gear knobs and mirror mounts, all with the aim of using metal 3D printing to manufacture operational components of an electric vehicle in 2021. In other words, for VW and for others, metal 3D printing as a means of routine, scale production of ferrous components is about this far away: two years.

Except that what is “routine” will come to look different when that time has come. And the “scale” production at that point will happen at a different scale. VW intends to use additive manufacturing to reduce the car’s weight and metal use by designing parts with complex lattice structures. It also intends to reduce the car’s part count and manufacturing complexity by designing consolidated parts that would otherwise be assemblies. Thus, the form of production parts will change. Meanwhile, given the reduced need to invest in hard tooling, VW will be able to leverage additive to manufacture in smaller batches and go to market with a smaller initial run of the new vehicle. Production quantities will therefore change as well.

These changes—these improvements to the nature of production—realize the advantages of additive manufacturing. These are the beneficial disruptions the technology can bring. Yet the worth of those positive disruptions is offset if the cost per part or cycle time per part presents a negative disruption. The benefits of additive manufacturing have arrived and they will continue to advance, but the leaders of the 3D Printing group at HP believe VW’s case illustrates something important about the potential for that advance. That is, the breakthrough enabler—the necessary precondition for the advantages of additive becoming widespread—will be metal AM with economies and efficiencies competitive with today’s production.

Related Content

AMGTA Research Demonstrates Sustainable Benefits of Binder Jet 3D Printing

Research from the Yale School of the Environment shows substantial reduction in GHG over traditional casting methods.

Read More7 Things We Saw at Formnext 2024 — Video Playlist

There were countless processes, applications and announcements at Formnext 2024. Here are seven standouts Peter Zelinski and Stephanie Hendrixson caught on film.

Read More3D Printed Metal Filters Protect Circuit Breakers from Explosion: The Cool Parts Show #57

New high-voltage circuit breakers from Schneider Electric make use of 3D printed metal filters to protect people and equipment in the event of an overload. Binder jetting provided both the geometric complexity and price point needed for these parts.

Read MoreBinder Jetting Vs. Metal Injection Molding: The Cool Parts Show All Access

Alpha Precision Group, provider of both processes, discusses considerations that go into making this choice.

Read MoreRead Next

Overcoming Obstacles to Bring AM into the Supply Chain

A conversation with Jabil’s John Dulchinos and HP’s Stephen Nigro illustrates some of the challenges in integrating additive manufacturing into a supply chain for production parts.

Read MoreVideo: HP on Additive Manufacturing for Production

HP’s Timothy Weber discusses VW’s plans for making metal parts via AM and the way forward to implementing additive as a production process.

Read More3D Printed Polymer EOAT Increases Safety of Cobots

Contract manufacturer Anubis 3D applies polymer 3D printing processes to manufacture cobot tooling that is lightweight, smooth and safer for human interaction.

Read More