Closing the Gap in Funding Additive Manufacturing

There is a large funding gap in advanced manufacturing and filling this void will take commitment from private organizations and the government to educate investors about potential returns within the complex $65 billion manufacturing technology industry.

Share

Read Next

Technology companies are some of the most popular investments today, but while equity investments focus on B2B and B2C software opportunities, there continues to be a large funding gap in advanced manufacturing. Filling this void, particularly for AM, will take commitment from private organizations and the government to educate investors about potential returns within the complex $65 billion manufacturing technology industry. Continuing to ignore the growing investment deficit may have long-lasting consequences for the future of manufacturing in America.

AM technology’s complexity, high capital requirements and interdisciplinary value chain are among the largest reasons for certain financial shortcomings. For some of manufacturing’s most prevalent technologies to date, such as CNC machining, advances have occurred at a slower pace, so companies could self-fund their own development processes and didn’t typically look to outside investment for support. That’s not the case for AM.

Historically, cycle times for AM innovation are much faster than other manufacturing technologies have been. AM is advancing so quickly that companies looking to use the technology struggle to keep up with the rapid pace of technical improvements. Investment is most needed to commercialize the early-stage technologies that provide a transition from proof-of-concept to repeatable performance in an end-use application.

“The cost to get the material, machine processes, inspection processes and the software to work together seamlessly is immense,” says David Burns, principal and founder at Global Business Advisory Services. “It’s a process that has previously taken manufacturing technology about a generation to achieve. With AM, we have a giant leap to make and the aggregate price tag to do it around the world will be many billions of dollars.”

But who is going to fill that gap? It’s going to take numerous private and governmental stakeholders with a long-term view to make a difference. Private investors may not consider manufacturing technology to be an attractive sector due to historically low growth rates and high capital expenditure requirements. AM is high growth but feels risky in nature compared to most manufacturing technologies and especially compared to B2B software. AM technology appears risky because many investors do not fully understand what they’d be investing in because there are so many types and uses of AM.

“Analysts are used to spending relatively few hours analyzing a potential deal, but that amount of time is insufficient to understand AM and be successful,” Burns says. “Although the potential for return is high, AM technology takes more money and moves more slowly than alternative investments do.”

Public-Private Research Partnerships Are Necessary, but Not Enough

To make AM equally available to everyone in the United States, someone needs to pay the bill to commercialize the early-stage technologies that create scale production capabilities and encourage adoption. In the case of CNC technology, the U.S. Department of Defense partnered with IBM in the 1960s because the government was buying most of the CNC technology. While the initial innovations were successful, they still struggled on the commercialization side.

“In the long history of funding the development of new technologies, there’s been little emphasis on commercialization and adoption,” says Pat McGibbon, chief knowledge officer at AMT. “Government programs and all research universities focus on the R&D. We need more support for the tech transfer scenario to enable a plant to take a new technology and use it.”

To further complicate funding challenges, AM’s workflow from initial concept to prototype and finished part is much more interdisciplinary than other manufacturing processes. AM works across material science, software, hardware, process and a number of different application verticals, but no single entity is dedicated to connecting all these necessary functions.

A Push in the Right Direction

Calls for onshoring and nearshoring may be a catalyst for increased investments in AM as more companies look for local suppliers and less reliance on overseas partners. There is an abundance of opportunity for domestic investment. When you add the costs for training people, building facilities and all the other support functions that go into an operation, the opportunity is tens of billions of dollars.

Holding back on investing in AM now can have negative consequences in the long term for supply chain flexibility and resilience. “If the United States doesn’t invest the money necessary to create the core science and commercialize it, other countries will and then they will own that technology,” Burns says. “The United States has all the creativity and resources necessary to be that country. We just have to catalyze it.”

Making a Difference Today

Currently, there are some government and private trade organizations trying to improve the funding for AM. America Makes is a public-private partnership for AM technology in which U.S.-based members collaborate to advance AM technology development, adoption and commercialization.

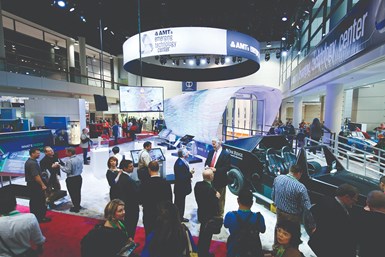

AMT conducts benchmarking surveys and market research to understand industry dynamics and the investments required to further advance new manufacturing technologies. For nearly a century, AMT has also produced the Western Hemisphere’s largest industrial event, IMTS – The International Manufacturing Technology Show.

IMTS 2022 takes place Sept. 12-17 at McCormick Place in Chicago. It will feature exhibits from nearly 2,000 companies — ranging from large international companies to small startups — and host 11 conferences, networking programs and attractions. AM will be on full display in these major areas:

- Additive Manufacturing Pavilion (West Building)

- AMT’s Emerging Technology Center (North Building)

- AM4U Area, presented by Formnext (West Building)

On Sept. 13-14, during IMTS 2022, AMT is hosting the inaugural IMTS Investor Forum, a two-day event for institutional investors, corporate and strategic professionals, and representatives from NGOs to gain insight into the funding gap, deepen their knowledge about the topics and experience emerging manufacturing technologies in person and up close. Attendees will be guided through curated tours of IMTS 2022 exhibitors in the Additive Manufacturing Pavilion, AMT’s Emerging Technology Center and eight other pavilions. At each stop, attendees can hear about the challenges, opportunities and differentiators that selected exhibitors see in their respective end markets.

“The awareness is really important,” McGibbon says. “We’re bringing all the relevant investor groups together to see where the technology is today, the size of the challenge before us and financial opportunities it presents.”

Manufacturers Take Strategic Interest in AM

Strategic companies in manufacturing are setting up ventures to invest in AM by supporting startups, making partnerships and potentially buying out those innovators who bring benefits to the organization. “Strategic manufacturers want to make sure they’re staying ahead of the technology curve to be competitive,” Burns says. “They want to get a pulse on what is happening out there and what can be strategically advantageous to their company in the short, medium or even long term. They’re a crucial link to aggregating good AM technologies together on a path toward relieving the funding gap.”

Current strategic manufacturers investing in AM include:

- AM Ventures — an AM-focused venture capital firm funded in part by the Langer family, who founded and built up EOS in the AM industry, and holds in their portfolio dozens of AM-centric companies such as Lightforce Orthodontics, a software-driven dental aligner solution paired with specialized 3D printing.

- Siemens’ Next47 funds startups across a range of hardware and software technologies. It financially backed Markforged’s continuous fiber-reinforced polymer extrusion AM process in 2017.

- Sixth Sense by Hexagon, an accelerator program for manufacturing technology, just announced two winners of its first cohort of startups — 3D printing company SmartParts and virtual factory planning company RIIICO.

As these private and government groups continue to see progress from financially backing AM development, there will be expanded visibility to the investor community, which brings hope for further commitments that would grow AM technology funding.

“In the long term, it is easy to see how productivity will be so much higher with AM that it will benefit everybody,” Burns says. “We’ll stop shipping things long distances, create products for less money and with better functionality, and we’ll reduce our use of resources. That increased productivity will improve the cost and quality of life on a global basis.”

Read Next

Alquist 3D Looks Toward a Carbon-Sequestering Future with 3D Printed Infrastructure

The Colorado startup aims to reduce the carbon footprint of new buildings, homes and city infrastructure with robotic 3D printing and a specialized geopolymer material.

Read MoreCrushable Lattices: The Lightweight Structures That Will Protect an Interplanetary Payload

NASA uses laser powder bed fusion plus chemical etching to create the lattice forms engineered to keep Mars rocks safe during a crash landing on Earth.

Read MoreProfilometry-Based Indentation Plastometry (PIP) as an Alternative to Standard Tensile Testing

UK-based Plastometrex offers a benchtop testing device utilizing PIP to quickly and easily analyze the yield strength, tensile strength and uniform elongation of samples and even printed parts. The solution is particularly useful for additive manufacturing.

Read More