5 Ways HP’s Center of Excellence Advances 3D Printing — and Manufacturing

The company’s 3D Printing and Digital Manufacturing Center of Excellence in Barcelona, Spain, will help advance Multi Jet Fusion and Metal Jet technology, in the interest of a digital manufacturing future.

“The 3D printing industry today is very small, but now is the point that we feel the technology is ready to scale,” says Ramon Pastor, global head of plastics solutions for HP Inc.’s 3D Printing and Digital Manufacturing business. Pastor is also manager of the Center of Excellence in Barcelona, Spain, where we spoke when I traveled there last week for its grand opening.

This building, the tenth on HP’s Barcelona campus, contains approximately 100 industrial 3D printers spread across its 150,000 square feet. Inside are R&D spaces for both the polymer Multi Jet Fusion (MJF) and Metal Jet platforms, materials science labs, co-development environments for working with partners and customers, and a number of additive manufacturing (AM) specialists (the company didn’t wish to disclose precise staffing figures, but says that this could be the largest concentration of such specialists in the world).While the 3D printing industry may be small today, HP believes in its trajectory and sees an inflection point on the horizon — one that the company even expects to bring closer.

“What we want is to accelerate the adoption” of additive manufacturing.

“What we want is to accelerate the adoption,” Pastor says. “I think we now have all the building blocks that we need.” Those building blocks extend beyond what HP itself provides; thanks to strategic partnerships, HP now offers an integrated solution that covers everything from design simulation to materials to facility management. Indeed, what this Center of Excellence represents is not just a vehicle for HP’s own technological advance or market share gain, but also one for the advance of AM at large through collaboration with partners and customers. According to Pastor and others with the company and its partners, here are some of the ways HP is thinking about and pursuing AM’s advance:

1. “Co-creation” enables partners to divide and conquer.

The company has little interest in being all things to all additive manufacturers. Rather than exert energy and resources to provide an end-to-end 3D printing solution alone, HP has doubled down on its role as 3D printer manufacturer and has sought out relationships with leading companies in 3D printing-adjacent specialties. These include GKN and BASF for materials, and Siemens for software solutions, with decisions informed by close collaboration with customers.

The term “co-creation” is part of the vocabulary at Siemens, according to Karsten Heusten, vice president additive manufacturing at the company. “We need to design software where the material is already in the software, where the machine is already connected to the software,” he says. “You don’t want to run 10 software solutions and incompatible materials. As a team, we can generate a really seamlessly integrated workflow.”

“If we all focus on our core jobs, we can be faster, we can have better solutions ...”

“If we all focus on our core jobs, we can be faster, we can have better solutions — and they are scalable,” added Volker Hannes, managing director of new business at BASF.

2. Applications are driving development.

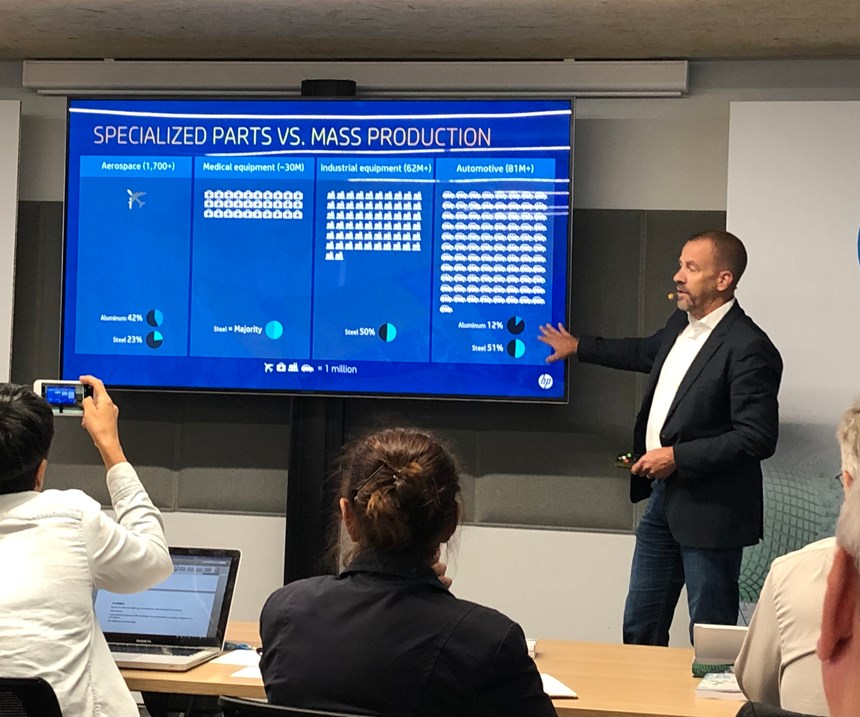

In both the metals and polymer spaces, HP believes it has a clear idea of where opportunities lie and where it wants to go. Close partnerships with other suppliers and customers and considered market research have informed decisions such as which industries to serve and which materials to offer. The Metal Jet platform is launching with steel, because HP sees the greatest opportunity for this platform in the industrial and automotive sectors.

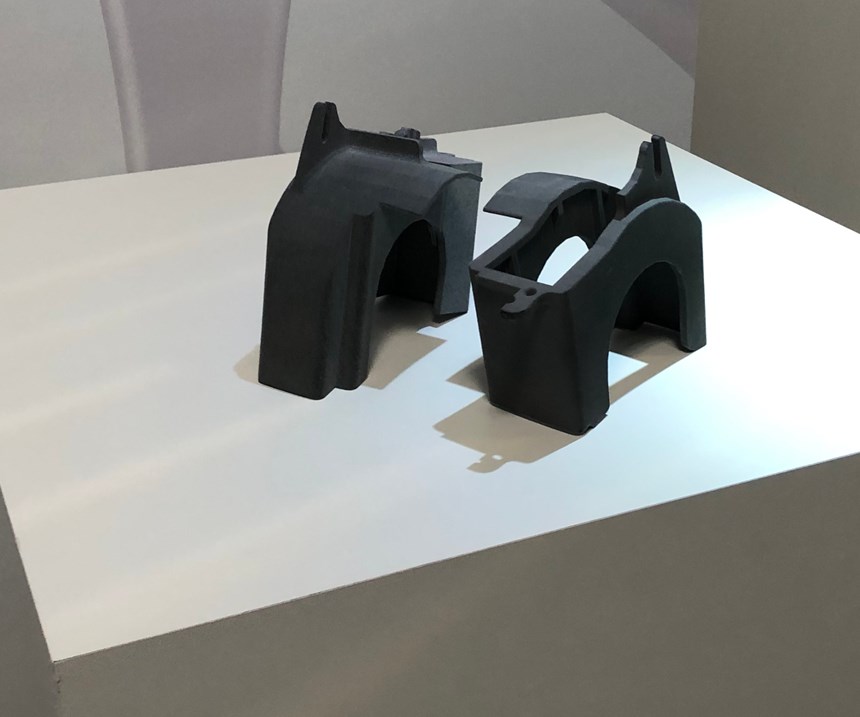

This same philosophy holds true on the polymer side, where applications are informing how the Multi Jet Fusion material portfolio is expanding. As Hannes put it, from a supplier perspective the conversation with customers is shifting away from “Here is the material” to “What is the application?” with application requirements serving as the starting point for material selection or development. BASF’s recently launched Ultrasint TPU01 powder for the MJF platform is an example; this 3D printing material was developed because of customer demand for a material that could be used for seals and flexible consumer goods such as footwear.

3. Mass production is imminent.

In 2018, all HP 3D printers across the globe produced a total of 10 million parts. Next year, a single Multi Jet Fusion user — Smile Direct Club — plans to print 20 million orthodontic molds with its fleet of 4200 series machines. With the launch of the new 5200 Multi Jet Fusion platform, the number of parts produced could rise even higher. This new series of MJF printers incorporates lessons learned from the 4200 and Metal Jet platforms with built-in redundancies, better sensors, wider material compatibility, and machine learning algorithms for preventive maintenance and process optimization. For the right part (preferably something small that packs efficiently into the build chamber), this platform could be cost-competitive with injection molding for quantities ranging to 100,000 or more per year. (The 4200 series will continue to be supported, however, as an option for lower volumes.)

4. Economic benefits (often) come first.

But where will all this production come from, and why will manufacturers shift parts to MJF? HP is seeing that often the first win for 3D printing comes down to cost for a new customer. If 3D printing can manufacture an existing part at a lower cost than conventional manufacturing, that’s a win. And once 3D printing gets a foot in the door, conversations about changing part designs and optimizing for AM allow for even greater benefits, such as lightweighting and assembly consolidation.

“The typical journey for a customer is based on pure economics,” Pastor says. “Once they have the machine, they begin to discover the power of the design freedom.”

5. 3D printing is a means to an end: digital manufacturing.

HP’s investment isn’t for 3D printing as an end in itself, but for what it potentially enables. “We are just one component of digital manufacturing. It goes beyond 3D printing,” says Christoph Schell, president of 3D Printing and Digital Manufacturing for HP. What 3D printing offers is a production technology compatible with a digital workflow. To that end, the Multi Jet Fusion platform is now heavily integrated into Siemens’ software portfolio for design, optimization, 3D printing preparation, and machine and plant simulation with digital twins, with support to manage the entire digital thread across the enterprise.

The ability to capture, store and analyze 3D printing data will be an enabler for the advance of manufacturing into mass customization, distributed manufacturing and on-demand production.

“We will give empowerment to manufacturers to manufacture and design where the customer is, and when the customer requires the product.”

“We will give empowerment to manufacturers to manufacture and design where the customer is, and when the customer requires the product,” Schell says. “Just think about the daily discussions right now on manufacturing, on shipments of goods and tariffs. All of this has an impact on what we’re doing here, and we have an impact on all of these discussions.”

Related Content

3D Printed "Evolved Structures" for NASA Exoplanet Balloon Mission: The Cool Parts Show #61

Generative design creates stiff, lightweight brackets for EXCITE mission monitoring planets orbiting other stars. The Cool Parts Show visits Goddard Space Flight Center.

Read More3D Printed Spacer Grids for Nuclear Power: The Cool Parts Show #79

Westinghouse Electric Company is exploring laser powder bed fusion as a means of manufacturing spacer grids, critical parts of the fuel rod assemblies used in pressurized water reactors.

Read MoreVariable Resistance Valve Trim Achieves Lead Time Reduction Through AM: The Cool Parts Show #69

Baker Hughes is realizing shorter lead times and simplified manufacturing through powder bed fusion to produce valve trims previously assembled from many machined metal parts.

Read More8 Cool Parts From Formnext 2023: The Cool Parts Show #65

New additive manufacturing technologies on display at Formnext were in many cases producing notable end-use components. Here are some of the coolest parts we found at this year’s show.

Read MoreRead Next

From Functional Parts to Lots of Functional Parts, AM Is Advancing into Production Scale

The assumption that additive is only for low-volume manufacturing is about to give way. Read these stories of companies getting ready for additive production at larger scales.

Read MoreVideo: HP on Additive Manufacturing for Production

HP’s Timothy Weber discusses VW’s plans for making metal parts via AM and the way forward to implementing additive as a production process.

Read MoreHP Enters Metal Additive Manufacturing with Production-Focused Binder Jetting Machine

A metal 3D printer for scale production of steel parts is the next extension of HP's additive offerings and the logical extension of printer technology the company has been developing for decades.

Read More

.jpg;width=70;height=70;mode=crop)