In Additive’s Evolution, Aerospace Proves the Fittest

As additive manufacturing shifts from prototypes to production, one industrial sector is ahead of the curve.

Five years ago, The Economist published a blue-sky analysis about additive manufacturing titled, “Print Me a Stradivarius,” in which the author wrote with high confidence about how AM will transform manufacturing from nearly every angle. The thousand-word story was peppered with sweeping declarations about AM’s future impact on design, production processes, workforce, profit margins and more—all culminating in “a technological change so profound [it] will reset the economics of manufacturing.”

For those familiar with the Gartner Hype Cycle, “Print Me a Stradivarius” could represent additive manufacturing’s last grip on the “peak of inflated expectations”—a period of mass publicity and overhyped promises around a burgeoning technology that falls sharply (into a “trough of disillusionment”) when the technology fails to deliver on those promises. As this publication’s editor-in-chief, Peter Zelinski, recently noted at the 2017 Additive Manufacturing Conference, realistically, industrial additive manufacturing today seems to be at the “middle of the beginning” of its evolution. This is a period defined by the Hype Scale as a “slope of enlightenment,” wherein AM’s benefits become more widely understood and the frequency of its successful utilization grows.

Yet, there is at least one industrial sector that has produced additive manufacturing success stories for years. And it’s no accident that, out of the myriad industrial applications for AM, aerospace continues to lead the pack when it comes to the implementation of additive processes and the deployment of additively produced parts.

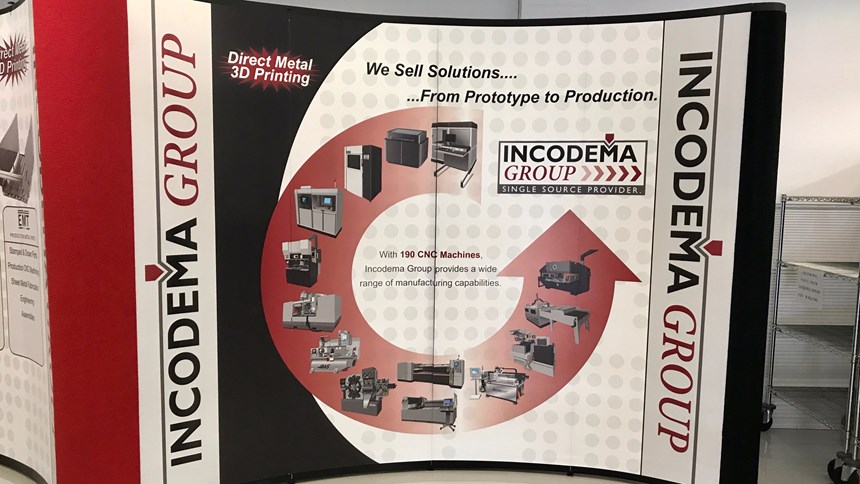

“Aero is leading the industry in initial investment in AM,” says Scott Volk, director of additive technologies and innovation at Incodema3D in Ithaca, New York. The company, founded in 2013 by Sean Whittaker as the latest addition to The Incodema Group, specializes in direct metal printing for prototypes and production quantities of parts, primarily for aerospace. While Volk emphasizes the sector’s financial investment in additive manufacturing, it is also—somewhat counterintuitively—aero’s rigid certification standards for parts that make the industry such a financially viable field of application for additive manufacturing. Incodema3D understands this, and is using its unique profile to take advantage of aero’s eagerness to engage with AM.

A Thoughtful Complement

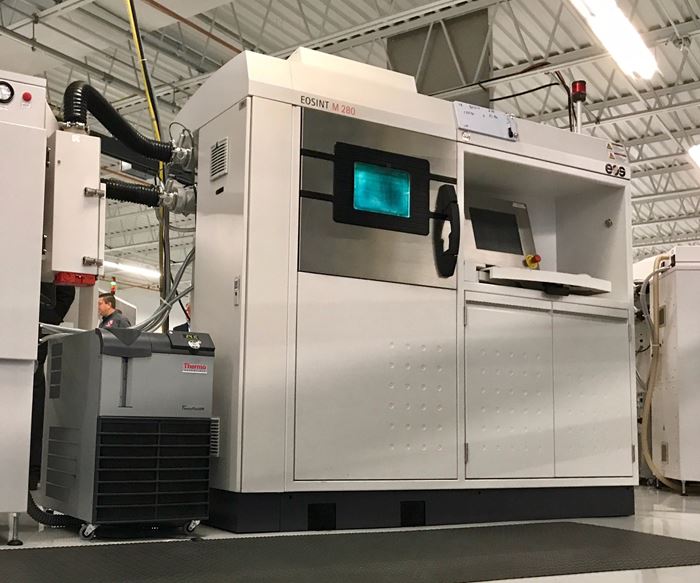

Today, Incodema3D’s goal is to equip itself for aerospace production. Lined up in rows across Incodema3D’s 60,000 square feet of floor space are a range of 3D printers that include, among others, six M280s from EOS, as well as two M290s and three M400s; two Pro X machines from 3D Systems (one of which is dedicated to titanium, and the other to Inconel 718); and a Renishaw AM400. Incodema3D maintains a metallurgist on staff and develops all of its own material parameters. The company is AS9100D-certified for aerospace, and was the first company in North America to be AMQ certified by EOS.

“Aerospace is all about documentation, and we control the whole process with documentation all of the way through.”

But Incodema3D’s secret weapon for aerospace production is its ability to turn to sister companies that perform traditional manufacturing for the postprocessing of its metal AM parts. As this article explains in more detail, Incodema3D is the newest of four companies that compose The Incodema Group, founded by CEO Sean Whittaker in 2001. Controlling the ancillary processes necessary for a metal AM part within the same family of companies represents a rare level of vertical integration among today’s additive manufacturers. It means that Incodema3D provides a seamless process along the entire manufacturing chain for aero—including the critical documentation process. James Hockey, Incodema3D director of business development, puts it this way: “We provide a fixed process from the powder on one end to the finished product on the other end. Aerospace is all about documentation, and we control the whole process with documentation all of the way through.”

While the Federal Aviation Administration (FAA) is currently shoring up its regulations for additively-produced parts, existing FAA certification processes already require thorough documentation for each step in the production of a flight-critical part. This gives a company like Incodema3D—with its unique ability to postprocess its additively produced parts—an advantage within the industry.

But from a purely financial perspective, the paramount reason that aerospace and aviation represent complementary sectors for AM is that they traditionally require low-volume production, perhaps 100 parts of a given component per year. Because those 100 parts must satisfy stringent requirements, the certification process drives up costs—a fact that is well established and already accepted by those sectors.

“To get something flight qualified,” Volk says, “there is a lot of information. To get a b-basis allowables program—just to have enough data for that, I mean, we’re talking about building a minimum of 1,200 specimens, which is a good 20 or 30 builds within this technology. And each of those builds is roughly $10K per build, so you’re looking at quite a bit of investment to get to a b-basis that is required for flight-critical qualification on a part.” (A “basis” is the confidence-level metric used for part certifications within aerospace.) It’s the convergence of these two qualities—aero’s ability to bear the high cost of the parts, and requiring low volume because of the industry’s lack of capacity—that provides a unique financial opportunity for additive manufacturers.

Related Content

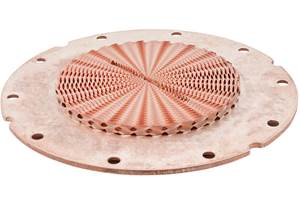

With Electrochemical Additive Manufacturing (ECAM), Cooling Technology Is Advancing by Degrees

San Diego-based Fabric8Labs is applying electroplating chemistries and DLP-style machines to 3D print cold plates for the semiconductor industry in pure copper. These complex geometries combined with the rise of liquid cooling systems promise significant improvements for thermal management.

Read More8 Cool Parts From Formnext 2024: The Cool Parts Show #78

End-use parts found at Formnext this year address various aspects of additive's advance, notably AM winning on cost against established processes.

Read MoreActivArmor Casts and Splints Are Shifting to Point-of-Care 3D Printing

ActivArmor offers individualized, 3D printed casts and splints for various diagnoses. The company is in the process of shifting to point-of-care printing and aims to promote positive healing outcomes and improved hygienics with customized support devices.

Read MoreDMG MORI: Build Plate “Pucks” Cut Postprocessing Time by 80%

For spinal implants and other small 3D printed parts made through laser powder bed fusion, separate clampable units resting within the build plate provide for easy transfer to a CNC lathe.

Read MoreRead Next

The Post-Production Challenge for Additive Manufacturing

The benefits of controlling postprocessing operations for additively produced parts reach beyond cost.

Read MoreAlquist 3D Looks Toward a Carbon-Sequestering Future with 3D Printed Infrastructure

The Colorado startup aims to reduce the carbon footprint of new buildings, homes and city infrastructure with robotic 3D printing and a specialized geopolymer material.

Read MoreProfilometry-Based Indentation Plastometry (PIP) as an Alternative to Standard Tensile Testing

UK-based Plastometrex offers a benchtop testing device utilizing PIP to quickly and easily analyze the yield strength, tensile strength and uniform elongation of samples and even printed parts. The solution is particularly useful for additive manufacturing.

Read More