Cracking the Code to Growth in AM

It takes more than machines on the shop floor to push additive manufacturing to the next level. According to one manufacturer, it takes customer service, education and training, too.

Master the machine technology. Check. Identify a market focus. Check. Establish yourself as a knowledge center. Check. Educate every customer on how to create a Center of Excellence. In progress.

That’s the next step in the Linear Mold & Engineering business model: be an innovative leader in tool building and part manufacturing using additive manufacturing (AM) technology. Linear says its mission, through its Centers of Excellence, is to educate more and more organizations on how to truly take advantage of AM. That is where the company gains a return on its own AM investment.

Two years ago we introduced you to Linear and its use of direct metal laser sintering (DMLS) to grow tooling inserts with cooling lines already designed inside, achieving maximum part quality and lower costs (short.moldmakingtechnology.com/linear0212). Linear also makes end-use parts through AM. For these two applications, it has identified two paths forward. In terms of conformal cooling, the company seeks to supply these inserts to other moldmakers. In production, it hopes to supply entire processes to customers.

Keeping Control and Concentration

Since 2012, increasing market demand for AM, along with Linear’s focus on getting the word out and putting boots on the ground to educate the industry, have combined to spur the company’s growth.

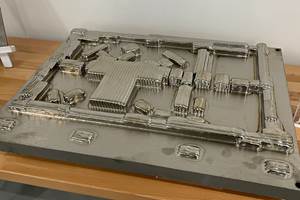

Two years ago, Linear had three EOSINT M 270 laser sintering machines from EOS GmbH and was looking at adding a fourth. Today, the company owns those four M 270 machines (that build with cobalt chrome, Inconel 625/718, maraging steel and stainless steels), two EOSINT M 280 machines (that build with aluminum, cobalt chrome, Inconel 25/718, maraging steel, stainless steels and titanium) and one SLM 280 selective laser melting machine from SLM Solutions GmbH (that builds with aluminum and titanium), and plans for two more machine acquisitions in 2014. It also has 11 CNC machining centers, various other machine tools and nine injection molding machines.

“We are a traditional tooling manufacturer that also provides AM,” says Lou Young, Linear’s director of new business development for tooling and manufacturing. “These two worlds come together under conformal cooling. We sell AM through the manufacture of conformal-cooled inserts.”

Traditionally manufactured tooling accounts for the highest percentage of the company’s business, followed equally by plastic parts manufacturing and AM. However, a shift is taking place. AM sales have skyrocketed each of the last two years, and Linear is projecting its AM sales to match the company’s tooling sales within the next three to four years.

A solid conformal cooling foundation, based on expertise in tool building and plastic parts manufacturing, has been the key to Linear’s growth in AM. So much so that it is the company’s fastest growing additive manufacturing segment.

Conformal cooling at Linear has changed quite a bit in the past two years. On top of its additional machine technology, finite element analysis (FEA) has allowed Linear to get more aggressive with water line design without ruining the integrity of its inserts.

“As you try to squeak water lines into the tightest areas possible, you run the risk of getting them too close to the part’s surface where they might fail under molding pressure, so we run FEA analysis in those cases to check stresses on the actual tool itself,” Young explains.

How the inserts are processed has been streamlined in the past two years as well. “We have more wire EDM equipment on the floor to finish the inserts as they come off the machines,” he says.

Linear’s mold simulation process, which is used to show customers the benefits of conformal cooling, has advanced, too, landing the company new business. “We take a customer’s existing production job, with its tool design and current molding parameters, and run a mold simulation with those exact parameters, tool design and conventional water lines,” Young explains. “This establishes a baseline in the simulation software. From there we construct a conformal cooling water line design with that same tool and run it with the exact same parameters. Both simulation results usually yield a job the next day.”

By running simulations with existing tools and parts in production, Linear establishes a baseline and then shows the customer what could be. Its approach proves that simulations applied in the real world work.

“By leveraging our equipment and experience, we are able to help customers maximize the benefits of conformal cooling, which include reduced cycle times, increased plant capacity, minimized scrap, a widened process window, noted quality improvements and improved flexibility in water line designs,” Young notes.

Linear’s strategy for growing the tooling side of its business is not necessarily to build more molds. Rather, it wants to supply conformal-cooled inserts to every tool shop in the country.

“We don’t want to build 1,000 molds a year,” Young says. ”We want to build the conformal-cooled inserts for those 1,000 molds a year. We want to help tool shops understand and use the technology, design the water lines, and run the simulations and FEA analyses on the tooling inserts.”

When it comes to plastic parts manufacturing, Linear is using its conformal cooling knowledge to make the company a better parts manufacturer. According to Young, one of the biggest drivers for conformal cooling so far this year has been molders’ desire to increase plant capacity without adding additional equipment.

For years, conformal cooling’s best-known advantage has been cycle time reduction and the resulting piece-price savings. However, Linear lately has been working with many large companies whose emphasis is not on piece-price reduction but rather on capacity, and this is where conformal cooling comes into play.

“You pick up any plastics trade magazine today, and you’ll read how they can’t make injection molding machines fast enough,” Young points out. “So, if you are able to reduce your cycle time by 30 percent on tools hanging in presses 24 hours a day, you’ll gain 8 hours of capacity on each press without having to buy another press. Conformal cooling helps make that happen by allowing you to reach the end-of-cycle temperature quicker.”

For the 3D metal printing portion of its business, Linear is taking more of a market focus in 2014. The company is looking not just at overall growth, but at growth in individual markets as well. Its strategy is to show customers tangible benefits such as how it can make or save them money. The high-value business that Linear is chasing involves opportunities to help customers with supply chain optimization, spare parts reduction and part redesign.

Creating Centers of Excellence

Linear believes it has also cracked the code when it comes to moving AM forward: knowledge sharing. The company has chosen not to hide or hoard the technology, but has established itself as a knowledge center, creating Centers of Excellence (COE) to guide customers so they too can take advantage of AM technology.

“A COE is where we provide our customers with a low-risk, turnkey service that includes AM equipment, personnel, maintenance, best practices training and technical support to help them duplicate on their site what we do at Linear every day,” explains Bruce Colter, the company’s director of new business development in additive manufacturing. It is this philosophy that has helped Linear position itself as a leader and innovator, and stay several steps ahead of its competition.

Here’s How the COE Model Works

The Centers of Excellence are supported by Linear Technical Services (LTS), a division of Linear that offers each customer COE five support components: equipment, talent, training, consulting and priority parts shipping.

Equipment is consigned to the customer’s site, but technology investment without the training is seen as a waste, so Linear offers access to personnel educated on all of its processes and comprehensive training. This includes training on all AM considerations, from concept to production. (If standard training does not meet a customer’s requirements, LTS also can develop a course or a set of modular courses tailored to specific needs. A custom course might include a combination of topics pulled from several standard courses or specialized material.) Training is followed up by consulting services that help to establish best practices specifically for the customer’s facility and with 24/7 on-call services by a Linear expert. The COE program, which typically lasts three years, is intended to enable the customer to begin making parts in days versus months.

Once Linear has trained a customer and that customer realizes its full potential, it likely won’t have the internal capacity to keep up with demand, so Linear’s support remains in the picture. In the end, Linear’s goal is to promote the benefits of the AM technology and enhance its customers’ market position, Colter maintains.

A COE is designed to help engineers and designers internally design for the AM process. It moves their minds to think in different ways and provides an onsite resource to help them redesign their supply chain with a new manufacturing dimension, he says.

“Market analysis reports that the potential of the AM marketplace will be $6–12 billion over the next decade, so our challenge is figuring out how to meet the demand,” Colter adds. “For that, we want the customer to think sintered parts, not stamped and welded parts.”

Related Content

This Drone Bird with 3D Printed Parts Mimics a Peregrine Falcon: The Cool Parts Show #66

The Drone Bird Company has developed aircraft that mimic birds of prey to scare off problem birds. The drones feature 3D printed fuselages made by Parts on Demand from ALM materials.

Read MoreActivArmor Casts and Splints Are Shifting to Point-of-Care 3D Printing

ActivArmor offers individualized, 3D printed casts and splints for various diagnoses. The company is in the process of shifting to point-of-care printing and aims to promote positive healing outcomes and improved hygienics with customized support devices.

Read MoreAt General Atomics, Do Unmanned Aerial Systems Reveal the Future of Aircraft Manufacturing?

The maker of the Predator and SkyGuardian remote aircraft can implement additive manufacturing more rapidly and widely than the makers of other types of planes. The role of 3D printing in current and future UAS components hints at how far AM can go to save cost and time in aircraft production and design.

Read MoreHow Norsk Titanium Is Scaling Up AM Production — and Employment — in New York State

New opportunities for part production via the company’s forging-like additive process are coming from the aerospace industry as well as a different sector, the semiconductor industry.

Read MoreRead Next

Bike Manufacturer Uses Additive Manufacturing to Create Lighter, More Complex, Customized Parts

Titanium bike frame manufacturer Hanglun Technology mixes precision casting with 3D printing to create bikes that offer increased speed and reduced turbulence during long-distance rides, offering a smoother, faster and more efficient cycling experience.

Read More3D Printed Polymer EOAT Increases Safety of Cobots

Contract manufacturer Anubis 3D applies polymer 3D printing processes to manufacture cobot tooling that is lightweight, smooth and safer for human interaction.

Read MoreCrushable Lattices: The Lightweight Structures That Will Protect an Interplanetary Payload

NASA uses laser powder bed fusion plus chemical etching to create the lattice forms engineered to keep Mars rocks safe during a crash landing on Earth.

Read More