25 Years Later, What’s Exciting in Electron Beam Powder Bed Fusion?

Often seen as runner-up to laser powder bed fusion, are we finally in the golden age of the electron beam?

“No, Mr. Bond. I expect you to die!” Now, if you are a James Bond fan, you’ll instantly recall that moment when you choked on your popcorn as a laser beam comes tantalizingly close to bifurcating a helpless James Bond, and Goldfinger turns around to utter that memorable line. Turns out Ian Fleming’s circular saw in the original 1959 novel was replaced by the hottest invention of the 1960s still looking for an application — the laser, so it would resonate with the audience at that time. Well, the electron beam was invented almost a decade earlier and was probably a harder scientific achievement, but we sure would be struggling to quote a movie that sent an electron beam after anyone, let alone zapped Jeff Bridges into Tron’s digital world.

Playing Second Fiddle

Lasers and electron beams have been competing for applications for more than half a century when both became viable technologies to precision weld metals. Electron beams produced a deeper weld penetration, but needed vacuum to prevent scattering of the beam, which meant an expensive vacuum chamber limited the size of applications. Lasers had a smaller weld penetration, didn’t require vacuum and were not limited by chambers, but were susceptible to gas contamination. They both had their value propositions and applications, though, as noted, pop culture only popularized one.

Fast forward to the late 80s and early 90s — researchers in the U.S., Germany and Sweden figured out how to weld a bed of metal powder inside a chamber into a complex 3D shape using both electron beams and lasers. Additive manufacturing’s (AM) laser powder bed fusion (LPBF) and electron beam powder bed fusion (EB-PBF) technologies were born. LPBF was commercialized by SLM Solutions and EOS in the mid-90s, while EB-PBF was commercialized by Arcam AB in 1997.

It may be unfair to compare electron beam and laser powder bed fusion as competing technologies, but it is no industry secret that after 25 years, EB-PBF remains far behind LPBF in terms of overall metal AM market adoption for various reasons. And this time pop culture is not to blame!

The Trough of Disillusionment

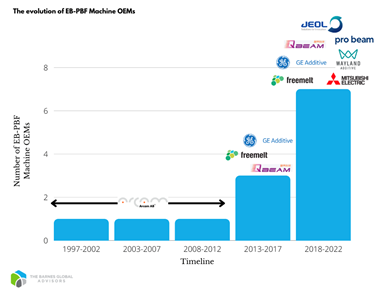

A look at how EB-PBF evolved in terms of machine OEMs over time (Figure 1) reveals two telling observations.

-

Arcam singularly competed alongside, and against, LPBF in advancing AM adoption for almost two decades.

-

GE’s acquisition of Arcam in 2016 to capitalize on this marketspace was followed by at least six new companies entering the playing field.

Let’s try to break this down further.

Understanding the interaction between the electron beam and powder characteristics, preventing undesired events such as powder smoking, and increasing the reliability and stability of the high-voltage architecture and vacuum chambers were all complex problems that likely raised the barrier to entry for new companies to pursue EB-PBF.

EB-PBF struggled to achieve the productivity of LPBF machines. To the parts manufacturer, the productivity gained by being able to print at higher layer thickness without residual stress was negatively affected by the time needed to pump up/down the vacuum, cool down the build, frequently replace cathodes and improve surface finish of the parts.

EB-PBF’s core advantage over LPBF was its ability to melt high-temperature, crack-prone and reflective alloys. The technology looked towards a high-value, weldable metal like titanium to establish a beachhead in the medical and aerospace markets. The extensive training requirements to develop process parameters and the lack of an open machine platform for the research community stifled the speed at which other materials were developed, leaving EB-PBF to become synonymous with titanium.

However, these were all solvable problems. Solving them just required resources, and competition to warrant those resources.

In that same timeframe, laser powder bed fusion became the hot bed of metal AM innovation and benefited from intense competition from several players, both big and small. Every new player and every new machine attempted to improve the LPBF process economics and make it riper for market adoption.

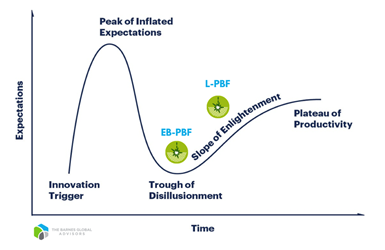

Metal AM became mesmerized by the promise of increased productivity enabled by laser proliferation, and coasted up the slope of enlightenment (Figure 2), while EB-PBF struggled in the trough of disillusionment.

Goldfinger must have seen this coming when he chose the laser.

Favorable Macro Trends

GE Additive, following its acquisition of Arcam in 2016, infused a sense of excitement into this space. It launched two new machines in reasonably quick succession aimed at higher productivity and developing new materials. In the last five years, at least six new companies entered the playing field to contend for EB-PBF’s untapped potential.

The timing of these new entrants also coincides with some macro trends that made the business climate more favorable for AM adoption. Overall, manufacturing’s awareness of AM has increased which is the tide that floats all AM boats. The Covid-19 pandemic exposed the lack of resilience in supply chains and prompted leading economies such as the U.S. to cast a renewed attention on boosting domestic manufacturing capabilities. The industry refused to accept a 52-week lead time for a casting as the norm when technologies like AM could deliver a replacement within a few weeks without any tooling. Emergence of AM certification and qualification standards in regulated industries such as aerospace and medical made the rules of engagement clearer than they ever were before. More AM applications were enabled by better design software, better training and awareness, and better value chain overall.

The focus gradually shifted from expensive pathfinder projects, that businesses pursued for fear of being left out, to mainstream production applications that required a solid business case. For AM to buy its way, the industry needed machines that were reliable, repeatable, and could deliver high throughput and productivity.

What is new about the EB-PBF market today that gives us hope for its bright future? From a macro basis, we see the same elements that propelled LPBF a decade ago, now forming to push EB-PBF into a productive ecosystem.

The Golden Age of EB-PBF

The six new entrants, Freemelt, Wayland Additive, JEOL, Mitsubishi Electric, QBeam and Pro-beam each have different origins, strengths and strategies.

Freemelt traces its roots back to Sweden, and its founders, to Arcam. Formed in 2017, the company’s strategy appears to leverage the broader research community with an open machine platform to accelerate development of new materials and applications, drive-up market adoption, and subsequently pivot into industrial production. Freemelt’s ability to grow, scale, and deliver reliable industrial systems down the line will be key to transitioning the new materials into production applications.

QBeam, spun off from China’s Tsinghua University in 2015 along with a team of its graduates, advertises two EB-PBF machines targeting medical and aerospace industries, and a third one aimed solely at materials research, much like Freemelt. With its first release in 2017, the company has built up five years of maturity, much more than any other company on this list. While being a regional player at the moment, it may be only a matter of time before they break into the global scene.

Pro-beam comes from Germany with expertise in the electron beam and laser welding, micro-drilling industry and surface coatings. The company is targeting the small-size, high-productivity application space with an EB-PBF machine, launched at Formnext 2021 alongside its wire based system. With a list of marketed features such as process parallelization, electron-optical in-situ monitoring system and a unique exposure strategy for better heat distribution, this newest entrant is expected to further elaborate on its industrialization plans.

Japan got into the game as well with a strategic investment in 2014 to bring industry and academia together to develop and commercialize the next generation of industrial 3D printers. This resulted in two new EB-PBF players — Mitsubishi Electric’s TADA Electric Co., and JEOL.

TADA, much like Pro-beam, aims to bring its electron beam welding expertise to the EB-PBF market with a 6-kW machine and a claim of a 1,000-hour cathode life. Claimed to be Japan’s first EB-PBF machine, Mitsubishi Electric’s brand and global presence may help with the machine gaining wider acceptance in the market.

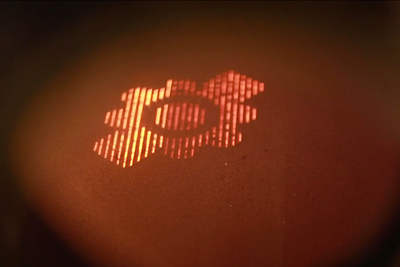

JEOL, on the other hand, comes with 70+ years of electron optics production coupled with 50+ years of electron beam metrology and lithography expertise, and made a splash at RAPID 2022 unveiling an industrial printer in North America. Interestingly, JEOL’s strategy to enter AM directly with an industrial printer ahead of any R&D printer is exactly the opposite of Freemelt, indicating that JEOL may be willing to bet its industrial readiness on its electron beam legacy and its established global service network in over 130 countries. Further, JEOL has advertised innovative solutions that directly target the EB-PBF pain points. The company’s proprietary vacuum technology, for example, reportedly results in a 1,500+ hours cathode life, the longest ever in an EB-PBF machine. JEOL’s solution for the powder smoking problem is a physical shield, dubbed the “e-shield,” which eliminates the need for helium, an expensive and non-renewable resource. JEOL also brings in its semiconductor lithography expertise to automatically correct the focus and shape of the electron beam during print to ensure a high degree of accuracy and repeatability of the parts, which is a key requirement for industrial machines.

Wayland Additive is a Series A funded U.K. startup that is attempting to transfer the mature electron beam technology from the semiconductor industry to the AM industry. Their primary focus is to address the powder smoking problem using a charge neutralization technology called NeuBeam, which uses an active stream of ions. Wayland also employs a hot part process, as opposed to a hot bed process, where hot temperatures are applied only to the powder that will make up the components being printed, rather than the entire powder bed. This could enable faster cooling rates and ease of powder removal. Wayland’s go-to-market strategy appears to be an industrial machine with open parameter access that can allow customers to develop materials of their choice. While Wayland’s agility as a startup might be advantageous, one hopes it is able to tackle the rigors of making a robust industrial machine for series production and build up a service network as it looks to scale.

Where does EB-PBF go from here?

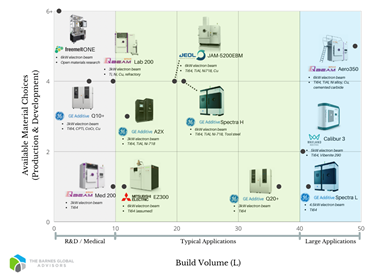

Mapping the EB-PBF machines in terms of build volume and the number of material choices available today (Figure 3) suggests competition in different market categories — R&D/medical, typical size, and large size applications. Freemelt One(0 to 6k-W beam) and QBeam Lab 200 (3-kW beam) are clearly aimed at rapid materials research and development with a small build volume. The GE Arcam Q10+ (3-kW beam) and the QBeam Med 200 (3-kW beam) are offerings specific to the medical industry where parts such as orthopedic implants have a small footprint. The GE Arcam Spectra L (4.5-kW beam), Wayland Calibur 3 (5-kW beam) and QBeam Aero 350 (6-kW beam) can serve a niche market need for printing large parts that cannot be achieved with a laser. JEOL JAM-5200EBM (6-kW beam) and GE Arcam Spectra H (6-kW beam) are in direct competition for introducing new alloys within the typical application space where most non-medical production applications fall today.

Competition in all three categories will hopefully force differentiation of offerings, breed movement of people and ideas, and help solve the EB-PBF pain points.

With the new entrants opening up the platform to develop and optimize new process parameters and focusing on improving the in-situ inspection capabilities, the EB-PBF state-of-the-art will certainly accelerate development of new alloys. Intermetallics, functionally graded multi-materials, shape-memory alloys, refractories and copper-based alloys can help unlock new applications beyond hip cups and jet engine blades in areas such as heat transfer, cutting tools, electromechanical motors, wear-resistant products, nuclear reactor components and other high-temperature applications.

Perhaps, if Goldfinger reveals that he never died and confronts his arch nemesis after all these years, he might want to make a different choice this time. But whether Goldfinger returns or not, it is certain that exciting times are ahead for electron beams.

Related Content

Beehive Industries Is Going Big on Small-Scale Engines Made Through Additive Manufacturing

Backed by decades of experience in both aviation and additive, the company is now laser-focused on a single goal: developing, proving and scaling production of engines providing 5,000 lbs of thrust or less.

Read MoreNew Zeda Additive Manufacturing Factory in Ohio Will Serve Medical, Military and Aerospace Production

Site providing laser powder bed fusion as well as machining and other postprocessing will open in late 2023, and will employ over 100. Chief technology officer Greg Morris sees economic and personnel advantages of serving different markets from a single AM facility.

Read MoreTop 10 Additive Manufacturing Stories of 2023

Laser powder bed fusion, proprietary AM processes, machining and more made our list of top 10 articles and videos by pageviews this year.

Read MoreTwo 12-Laser AM Machines at Collins Aerospace: Here Is How They Are Being Used

With this additive manufacturing capacity, one room of the Collins Iowa facility performs the work previously requiring a supply chain. Production yield will nearly double, and lead times will be more than 80% shorter.

Read MoreRead Next

JEOL Brings Electron Beam Melting and a Taste of Japan

The supplier of electron beam technology is entering the additive market with its first 3D printer.

Read MoreNeuBeam 3D Printing Process Is an Update for Electron Beam Melting

The recently introduced Calibur3 system from Wayland Additive overcomes challenges to bring new materials and capabilities to EBM metal 3D printing.

Read MoreVideo: What Is Laser Powder Bed Fusion (LPBF)?

Laser powder bed fusion is likely the most widely used metal additive manufacturing process. Here is how it works, including benefits, issues to consider and applications for this 3D printing technology.

Read More