Impressions of Rapid + TCT 2017

Low-cost metal machines were the prominent new introduction to a show that has perhaps completed its transformation into an industrial manufacturing event

Here’s a problem: This year, it is not possible for me to accurately describe and summarize my impressions of the annual Rapid trade show and conference without mentioning the company Desktop Metal multiple times. This company was, with little doubt, the most prominent exhibitor at the show. Part of this prominence was provided directly—the company obtained from the show organizers various branding and positioning opportunities, including a keynote. But part of the prominence is also a function of the moment. Desktop Metal legitimately touches on and demonstrates various developments that are important in additive manufacturing right now.

Here is another, smaller problem with reporting on the event: The show this year has been renamed Rapid + TCT. Of course, that is not the name by which the show is naturally referred to, particularly by repeat attendees. (Social media compounds the problem, carrying forward the accepted name in legacy hashtags.) This article will refer to the show as both Rapid and Rapid + TCT.

By the standards of the show’s history, the event this year was huge. Attendance was 6,000, up 35 percent from last year. A total of 329 exhibitors filled 70,000 square feet, with those numbers up 31 percent and 56 percent, respectively, from last year. The show has been growing dramatically year by year, and this year that growth clearly continued.

This year, the show matured. Perhaps I reveal my own bias and expectations in saying that. (I am a manufacturing guy.) This year, Rapid was fully and obviously a manufacturing show. Colleagues of mine attending the show for the first time would have had a hard time seeing it any other way. But I have been attending the show for years, so I have a different perspective. Not long ago, much of the exhibit space and much of the visual focus of exhibits was given over to other anticipated end uses of 3D printing, with displays showing models of SF characters, dinosaur heads and artistic sculptures. Yet over those years, I have been noting the show’s gradual increase in emphasis toward the application of 3D printing to industrial component production, the application I think most would agree offers the greatest ultimate promise. Now, this might be the last year I talk about that transition of the show, because the transition appears to be done. All the many and varied applications of 3D printing are still to some extent touched on and present at Rapid, but this has now become a show about additive manufacturing.

That is not to say that AM itself has fully arrived, or that additive as a means for industrial production is anywhere near mature. Though AM is now established enough that many manufacturers are succeeding with it, the various component and enabling technologies of AM are still advancing in important and necessary ways. Here is how I saw some of the incremental moves of that advance playing out during my time last week at Rapid:

1. Metal AM for the Masses

The aforementioned Desktop Metal has this year introduced a low-cost metal additive system. The introductory system from this company has a low six-figure price rather than the high-six-figure price more common for metal printing. The potential impact is obvious—a lower price of admission potentially means a broader range of cost-effective applications for 3D printing in metal. Desktop’s system also aims to make AM more accessible in other ways as well (read on).

Importantly, Desktop is not alone. MarkForged also showed a system similar to Desktop’s, using a method based on FDM to build parts from metal powder. And also present at Rapid, though this company is youngest of all, Xact Metal introduced a powder-bed fusion metal additive machine with a 5-inch build cube for a low-six-figure price ($120,000) that is equal or comparable to these other companies' systems.

2. Partnerships and Possibilities

Something else worth mentioning on the theme of metal AM potentially becoming more accessible for the mainstream of manufacturing is this: Both Desktop Metal and MarkForged announced industrial partnerships at the show. MarkForged units will be sold by Methods Machine Tools. The Desktop system will be sold by Stratasys resellers, which presumably includes Gosiger, the manufacturing technology supplier announcing its partnership with Stratasys last year. In short, these two low-cost metal 3D printing solutions will now find applications in part through the efforts of established machine tool sales organizations.

And on the related theme of AM in general advancing, one simple but important observation of walking around the Rapid show floor is that the newer exhibitors to the show include many relatively new offerings increasing the alternatives in the 3D printing marketplace. An example: Large-format 3D printers were once an impressive curiosity, but various companies (3D Platform and BigRep were two I spoke with last week) now offer a range of options in the large-format space. Another example: Plural Additive Manufacturing was at Rapid + TCT with an industrial 3D printer for applications that traditionally would be associated with Stratasys's established Fortus machine.

Part of the new product introduction has been enabled by patent expirations. But more broadly, these signs—new competitors and sales channels—suggest a market and a range of technologies finding their footing. The innovation has to come first, then the refinement, prove-out and acceptance of that innovation (the part of the advance that can take a long time). But then come the companies actively competing to find the various opportunities and various pathways for bringing the proven solutions to their various logical users. Overall, we are still in the “refinement, prove-out and acceptance” stage, but we are already beginning to see the coalescing of what comes next.

3. Software Enables Success

Stratasys at Rapid this year introduced its latest technology “demonstrator” concept, the Continuous Build system. Like the two demonstrators introduced at IMTS, this system is a working model the company hopes to refine over time before it becomes a standard product—and in the case of the Continuous Build it is already being used by some customers. This system debuted at Rapid provides for continuous 3D printing production by marrying an array of identical 3D printer modules (or print engines) with automation on the front and back ends—namely, hardware automation on the back end for pushing finished parts out of the printer and software automation on the front end for queuing, organizing and initiating various 3D printing jobs sent to the array.

Arguably, the software is the more significant part. Built on Stratasys's GrabCAD software (an acquired technology), the software enables unattended continuous production by assigning 3D printing jobs according to machine capacity, initiating those jobs, and rerouting jobs into parallel print engines on the fly to keep production going in case of an unexpected fault that disrupts the use of any single engine.

This hardware-plus-software advance illustrates a straightforward point. Namely: Production via 3D printing is not just about the printer, not just about the hardware. As with modern manufacturing in other areas, succeeding with additive manufacturing is naturally going to draw on digital technologies.

Autodesk has much to say about this. The established manufacturing software company continues to develop not only design software tools suitable for AM parts, but also its Advanced Toolpath capability for metal AM offering options for the laser and its pattern of movement within a metal additive machine that go beyond the resident software offered by machine manufacturers.

And another software company with something to say in this area is CGTech. The first-time Rapid exhibitor is known in the CNC machining space as a provider of software for simulating and verifying complex programmed routines on machine tools, as an alternative to discovering collisions and interferences through physical prove-out on these machines. Now, the company offers software for simulation of additive manufacturing as well, an idea that arguably makes even more sense in additive given the typically even greater cost of time on these machines.

Indeed—and here is one more reference to Desktop Metal—software is an important part of the development this company has made that shouldn’t be overlooked alongside its new hardware. Desktop offers a cloud-based software interface for importing and working with part models not just in STL but also in other major CAD formats as well (even IGES). This interface also automatically nests different models within the build volume and—this part is fun to play with—it automatically changes the build setup to fit the user’s optimization priorities. Slider bars let the user express a set of preferences among the build time, the portion of surfaces in need of support, the amount of material used and the printed surface quality. Then, the orientation of the part automatically changes (for example, from an orientation maximizing speed to one sacrificing time for the sake of using less material in supports) in line with these interactively expressed priorities.

4. Look to Materials

Arguably the area of the most important and significant advance now is one that is very difficult to communicate at a trade show: materials. In a conversation with a representative of EOS, near EOS machines offering various visible advances, the talk turned away from the equipment to the importance of the properties of a particular steel. With good reason. The company’s 17-4PH stainless steel is heat-treatable to properties recognized and proven for medical applications, facilitating the further advance of AM into applications in this sector.

On the polymer side, an example of a company involved in this kind of advance is Sabic. And this company faces the struggle to which I allude above—that is, how do you show the work of polymer engineering at a trade show? Its answer at Rapid included a yacht section combining different materials. But whether the work is visible or not, the ongoing development of material options for AM—both polymer materials and metal—represents the most significant work still ahead for continuing to advance 3D printing toward its full promise in manufacturing.

At Rapid, Sabic introduced an array of PEI, ABS and polycarbonate filaments for use in Fortus 3D printers, and also emphasized its materials engineered for large-format 3D printers (used for the yacht, for example). But the work in this area is still young. Thousands of materials exist for conventional plastics processing, particularly injection molding. And as Sabic notes, those materials exist because applications arose that had need for the properties of every one of those materials. For 3D printing to serve something like the same range of applications, it will need the same range of material possibilities. Today, that leaves the materials portion of AM as the area with perhaps the largest field of potential work remaining yet to do.

Related Content

Postprocessing Steps and Costs for Metal 3D Printing

When your metal part is done 3D printing, you just pull it out of the machine and start using it, right? Not exactly.

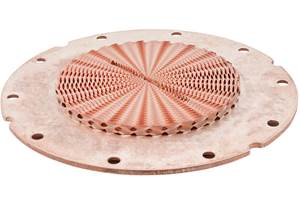

Read MoreWith Electrochemical Additive Manufacturing (ECAM), Cooling Technology Is Advancing by Degrees

San Diego-based Fabric8Labs is applying electroplating chemistries and DLP-style machines to 3D print cold plates for the semiconductor industry in pure copper. These complex geometries combined with the rise of liquid cooling systems promise significant improvements for thermal management.

Read MoreVideo: 5" Diameter Navy Artillery Rounds Made Through Robot Directed Energy Deposition (DED) Instead of Forging

Big Metal Additive conceives additive manufacturing production factory making hundreds of Navy projectile housings per day.

Read MorePossibilities From Electroplating 3D Printed Plastic Parts

Adding layers of nickel or copper to 3D printed polymer can impart desired properties such as electrical conductivity, EMI shielding, abrasion resistance and improved strength — approaching and even exceeding 3D printed metal, according to RePliForm.

Read MoreRead Next

Crushable Lattices: The Lightweight Structures That Will Protect an Interplanetary Payload

NASA uses laser powder bed fusion plus chemical etching to create the lattice forms engineered to keep Mars rocks safe during a crash landing on Earth.

Read MorePostprocessing Steps and Costs for Metal 3D Printing

When your metal part is done 3D printing, you just pull it out of the machine and start using it, right? Not exactly.

Read MoreBike Manufacturer Uses Additive Manufacturing to Create Lighter, More Complex, Customized Parts

Titanium bike frame manufacturer Hanglun Technology mixes precision casting with 3D printing to create bikes that offer increased speed and reduced turbulence during long-distance rides, offering a smoother, faster and more efficient cycling experience.

Read More